Lithium

- Lithium is best known today as an ingredient of lithium-ion batteries.

- Li-7 as a hydroxide is important in controlling the chemistry of PWR cooling systems.

- Li-7 is a key component of fluoride coolant in molten salt reactors.

- Li-6 is a source of tritium for nuclear fusion, through low-energy nuclear fission.

- The world faces a potential shortage of lithium by 2025 due to rising demand for lithium.

Lithium is the lightest metal, which occurs in several hard rock types, notably spodumene, and in brines, hence it is often mined in salt lakes, particularly in South America.

The majority of mined lithium (about three-quarters) is used for batteries. This proportion is growing each year, and has risen from about 40% in 2016. The balance is used for ceramics and glass, as well as various other uses. However, a 2021 report from the International Energy Agency (IEA) suggests that, in the future the use of lithium will be dominated by clean energy technologies, with a 90% share of demand.

According to the United States Geological Survey (USGS), the majority of lithium is produced through hard rock mining in Australia and China, producing 49% and 17% of global lithium resources respectively. The remaining lithium is produced through brines in Chile and Argentina, providing 22% and 8% respectively.

Lithium has two stable isotopes, Li-6 and Li-7, the latter being 92.5% in nature (hence relative atomic mass of natural lithium of 6.94).

Nuclear industry use: Li-7

Lithium-7 has two important uses in nuclear power due to its relative transparency to neutrons. As hydroxide it is necessary in small quantities for safe operation in pressurised water reactor (PWR) cooling systems as a pH stabilizer, to reduce corrosion in the primary circuit. As a fluoride, it is also expected to come into much greater demand for molten salt reactors (MSRs). However, for both purposes it must be very pure Li-7, otherwise tritium is formed by neutron capture (see later section).

99.95% Li-7 hydroxide is used in nuclear power engineering as an additive in PWR primary coolant, at about 2.2 ppm, for maintaining water chemistry, counteracting the corrosive effects of boric acid (used as neutron absorber) and minimizing corrosion in steam generators of PWRs. It is also used in the manufacture of chemical reagents for nuclear power engineering, and as a basic component for preparation of nuclear grade ion-exchange membranes which are used in PWR coolant water treatment facilities.

Lithium-7’s very low neutron cross-section (0.045 barns) makes it invaluable for nuclear power uses.

The Nuclear Energy Institute has described Li-7 supply as critically important for the US nuclear industry. In 2013 the US Department of Energy planned to set aside 200 kg of Li-7 in reserve, and has been funding research on production methods.

World demand for Li-7 in PWR cooling systems is about one tonne per year, including about 400 kg annually for 65 US PWRs (Russia uses a different pH control process). When MSRs are built, tens of tonnes of pure Li-7 would be required in each. Demand for Li-7 could readily reach 250 t per year with the kind of construction programme envisaged by some, though it forms part of the capital set-up, not a consumable.

As a fluoride, Li-7 is used in the lithium fluoride (LiF) and the lithium-beryllium fluoride (FLiBe) that comprise the coolant salt in most MSRs that are the focus of intensive development. Very high levels of purity are required, up to 99.995% Li-7. In most cases the coolant salt also has the fuel dissolved in it. Such fluoride salts have very low vapour pressure even at red heat, carry more heat than the same volume of water, have good heat transfer properties, have low neutron absorbtion, are not damaged by radiation, do not react violently with air or water, and some are inert to some common structural metals.

LiF is exceptionally stable chemically, and the LiF-BeF2 mix (‘FLiBe’) is eutectic (it has a lower melting point than either ingredient – a 2:1 mixture of LiF and BeF2 has a melting point of 459°C; the melting point of BeF2 is around 550°C; that of LiF is about 850°C). FLiBe is favoured in MSR primary cooling, and when uncontaminated has a low corrosion effect. The three nuclides (Li-7, Be, F) are among the few to have low enough thermal neutron capture cross-sections not to interfere with fission reactions. FLiNaK (LiF-NaF-KF) is also eutectic and solidifies at 454°C. It has a higher neutron cross-section than FLiBe or LiF but can be used in intermediate cooling loops, without the toxic beryllium.

Non-nuclear lithium uses

Lithium is widely used in lithium-ion batteries, including those for electric cars, either as natural lithium or with an enhanced proportion of Li-6 which improves performance, utilizing chemically-pure tails from enriching Li-7. About 39% of world lithium supply in 2017 was used in batteries, 30% in ceramics and glass. According to the United States Geological Survey (USGS), around three-quarters of lithium is used for batteries. The remaining share is mostly used for ceramics and glass, accounting for almost 15%.

Sources of and demand for lithium

Lithium is not a scarce metal. It occurs in a number of minerals found in acid igneous rocks such as granite and pegmatites, spodumene and petalite being the most common source minerals. Due to its solubility as an ion it is present in ocean water and is commonly obtained from brines and clays (hectorite). A conservative estimate of an average of 20 ppm is in the Earth’s crust, making lithium the 25th most abundant element.

According to estimates by the United States Geological Survey (USGS), identified worldwide lithium resources in 2022 are about 89 million tonnes (Mt). Bolivia has the largest lithium resources in the world with 21 Mt, followed by Argentina (19 Mt), Chile (9.8 Mt), the USA (9.1 Mt), Australia (7.3 Mt) and China (5.1 Mt).

Excluding withheld US production statistics, world production in 2020 was around 82,500 t. Australia was the leading producer with 39,700 t, followed by Chile (21,500 t), China (13,300 t), Argentina (5900 t), Brazil (1420 t) and Zimbabwe and Portugal, which both produced less than 500 t.

There are some concerns over lithium shortages in the future. Although in theory there are sufficient resources to meet anticipated future demand, there are questions over whether reserves can be accessed and if they can, whether the quality of the lithium is adequate.

Credit Suisse has said that lithium demand could potentially treble between 2025 and 2025 – predicting that supply would be stressed to meet demand.

In its report titled The Role of Critical Minerals in Clean Energy Transitions, the IEA said that the world faces potential shortages of lithium by 2025, unless “sufficient investments are made to expand production.”

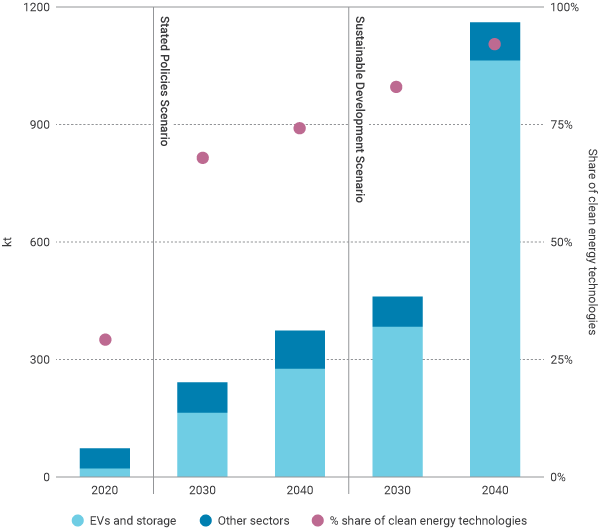

In 2020 lithium demand was around 74,000 tonnes per year, with approximately 30% of demand coming from electric vehicles and energy storage (22,000 t). In the IEA’s scenario consistent with sustainable development goals, lithium demand reaches 1,160,000 t by 2040 and electric vehicles and energy storage account for about 90% of the total (see Figure).

Total lithium demand by IEA scenario

Brine operations are typically less costly than hard rock mining, costing $3000 per tonne (pt) less ($4000/t for brine operations compared to $7000/t for hard rock). However, brine operations require several years for evaporation ponds, meaning they take longer to start than rock operations, which can begin after around five years.

According to the IEA, between 2010 and 2019, lithium mines took an average of 16.5 years to develop, with 80% of mining projects completed late.

Properties of lithium, different isotopes

Lithium* easily ionizes to Li+, and LiOH forms readily. Lithium is the only stable light element which can produce net energy through fission (albeit only 4.8 MeV for Li-6, compared with about 200 MeV for uranium).

* Atomic number 3, melts 180.5°C, boils 1330°C. It is the lightest metal and the least dense solid element (about half as dense as water). It is highly reactive and flammable, like other alkali metals.

Lithium-6 has a very high neutron cross-section (940 barns) and so readily fissions to yield tritium and helium. It has been the main source of tritium for both thermonuclear weapons and future controlled fusion. Natural lithium is enriched in Li-6 for this purpose, leaving tails enriched beyond the natural 92.5% in Li-7.

Lithium isotope separation

Isotope separation of Li-6 and Li-7 can be achieved chemically, using the column exchange (Colex) separation process, and also with laser processes on metal vapour, or crown-ether separation. In China, SINAP has developed centrifugal extraction.

With mercury-based separation, Li-6 has a greater affinity to mercury than its more common partner. When a lithium-mercury amalgam is mixed with lithium hydroxide, the lithium-6 concentrates in the amalgam and the lithium-7 in the hydroxide. A counter-flow of amalgam and hydroxide passes through cascades followed by separation of the lithium-6 from the amalgam. Today this is undertaken only in Russia and China, though it was greatly used in the USA earlier, with major environmental impact. A lot of mercury is required – 11,000 tonnes was used in the USA – a significant amount being lost to “wastes, spills and evaporation”. Further use of the Colex process is banned in the USA*.

*The USA became the prime producer of lithium from the late 1950s to the mid-1980s, by which time the stockpile was about 42,000 tonnes of lithium hydroxide. Lithium enrichment (to Li-6) has created a large US inventory of both tailings depleted in Li-6 (at Portsmouth, Ohio and K-25 site at Oak Ridge, Tennessee) and unprocessed lithium. Most of this, notably Li-7, was then sold on the open market. Production of lithium-7 had ceased in the USA in 1963, partly because of environmental and health and safety concerns with mercury which was used in its enrichment.

Today the only sources of Li-7 (enriched from natural lithium) are Russia and China, though the latter is reported to be buying from Russia. Production of lithium-7 at least in Russia and possibly China is as a by-product of enriching lithium-6 to produce tritium for thermonuclear weapons.

TVEL’s Novosibirsk Chemical Concentrates Plant (NCCP) in Siberia is the largest supplier of Li-7 hydroxide monohydrate (with purity up to 99.95%), meeting up to 80% of the world’s requirements. It is produced by electrolysis of lithium chloride solutions using mercury.

Li-7 hydroxide monohydrate produced by the NCCP accounts for the majority of Li-7 world consumption (by isotopic composition) for the nuclear industry. Equipment modernization carried out in 2013 made it possible to double the volume of Li-7 output there. The NCCP also produces metallic lithium for catalysts and batteries, and granulated lithium chloride.

Atomic vapour laser isotope separation (AVLIS) appears appropriate for smaller quantities to serve the needs of PWRs. At about 700°C Li-7 is photo-ionised selectively, giving highly-effective separation in an electromagnetic field, sufficient in one pass for PWR use. Several features of AVLIS mean that pure Li-6 is not produced.

Crown-ether enrichment using mixer-settler system appears best for larger-scale production such as envisaged for MSR fluorides. Certain ethers have ring properties that make them inclined to bond more with specific isotopes than others, and either resin columns or a water-insoluble solvent containing the crown ethers is added to an aqueous mixture of lithium, and the Li-6 concentrates in the solvent phase for removal. Concentration factors of 1.05 are comparable with the Colex process. Two crown ethers appear economically attractive: benzo-15-crown-5 and dicyclohexano-18-crown-6.

The Shanghai Institute of Applied Physics (SINAP) under the China Academy of Sciences, has developed a centrifugal extraction method, and counter-current extraction has achieved 99.99% purity Li-7.

References:

http://www.australianminesatlas.gov.au/aimr/commodity/lithium.html#world_ranking

Anderson, E.R. TRU Group 2011, Shocking future battering the lithium industry through 2020

Nuclear Energy Institute, Industry Watching Supply of Lithium-7 for US PWRs (9 December 2013)

Tim Ault et al, Lithium Isotope Enrichment: Feasible Domestic Enrichment Alternatives, University of California, Berkeley, Report UCBTH-12-005 (5 May 2012)