Uranium and Nuclear Power in Kazakhstan

- Kazakhstan has 12% of the world's uranium resources and in 2023 produced about 21,100 tU.

- In 2009 it became the world's leading uranium producer, with almost 28% of world production. In 2022, Kazakhstan produced 43% of the world's uranium.

- A single Russian nuclear power reactor operated from 1972 to 1999, generating electricity and desalinating water.

- Kazakhstan has a major plant making nuclear fuel pellets and aims eventually to sell value-added fuel rather than just uranium. A fuel fabrication plant is being built with 49% Chinese equity.

- In October 2024, 70% of voters backed new nuclear energy in a national referendum.

Kazakhstan has been an important source of uranium for more than 50 years and became the world's largest uranium producer in 2009. Annual production increased from 2114 tU in 2001 to 24,689 tU in 2016, before decreasing slightly due to low uranium prices. In 2019 production was 22,808 tU, up 5% on the year before, but dropped to 19,477 tU in 2020 due to the impact of the coronavirus pandemic. Production in 2023 was 21,112 tU and National Atomic Company Kazatomprom Joint Stock Company (Kazatomprom) has said it expects 2024 production to be 21,000-22,500 tU.

Of Kazakhstan's 13 uranium mining projects, three are wholly-owned by Kazatomprom and 10 are joint ventures with foreign equity holders. In 2023, Kazatomprom's share of production was 11,170 tU.

Electricity sector

Total generation (in 2021): 115 TWh

Generation mix: coal 68.0 TWh (59%); natural gas 30.8 TWh (27%); hydro 9.2 TWh (8%); wind 1.8 TWh (2%); solar 1.7 TWh (1%).

Import/export balance: 0.5 TWh net export (2.1 TWh imports; 2.6 TWh exports)

Total consumption: c. 87 TWh

Per capita consumption: c. 4572 kWh

Source: International Energy Agency and The World Bank. Data for year 2021.

Kazakhstan has northern and southern electricity grids with some connection, and links to Russia, and to Kyrgystan and Uzbekistan, respectively. On 1 January 2023 the Kazakhstan Electric Grid Operating Company (KEGOC) reported installed capacity of 24.5 GWe, of which 20.8 GWe was available.

Energy policy

In 2012 the government's energy system development plan had 150 TWh/yr production in 2030, with 4.5% of this from nuclear and 10% from renewables. In November 2012, the Minister of Industry and New Technologies said KZT 9.4 trillion (around $62 billion) would be invested in the power generation sector by 2030, approximately 40% of which would be in transmission and distribution.

In December 2012, the President launched Strategy Kazakhstan-2050: A New Political Course of the Established State, which aims to place the country within the top 30 most developed nations in the world. In line with the strategy's aim to "move swiftly towards a low-carbon economy," the May 2013 decree #557 on the Concept for the Transition of the Republic of Kazakhstan to Green Economy outlines a target for the power sector to achieve a 50% share of alternative and renewable energy by 2050, including 1.5 GWe of nuclear capacity by 2030 and 2.0 GWe by 2050.

The question of nuclear power in Kazakhstan has been discussed for many years, notably since 2006 with Russia, and a national nuclear strategy was expected in 2018. In September 2021 the country’s president said: “Kazakhstan needs a nuclear power plant.”

Kazatomprom is the national atomic company set up in 1997* and owned by the government. It controls all uranium exploration and mining as well as other nuclear-related activities, including imports and exports of nuclear materials.

* Prior to Kazatomprom’s establishment, other arrangements pertained for uranium development. One of these was with Canada-based World-Wide Minerals Ltd (WWM), under a 1989 bilateral investment treaty between Canada and the USSR. WWM invested heavily in the country over 1996-97, upgrading and operating the Tselinny (TGK) uranium mining and processing facilities at Stepnogorsk, with an option to acquire 90% equity in them as well as developing additional mines. WWM and subsidiaries entered into agreements with the Kazakh government, but claim that the government frustrated its endeavours, leading to a loss of more than $50 million and its exit from the country. In October 2019 an international arbitral tribunal upheld WWM’s claims under investor-state arbitration and awarded over $50 (including over $8 million in costs) to WWM. However, in November 2020 the award was set aside by the English High Court and remitted WWM's claims to the arbitral tribunal.

Originally wholly-owned by national wealth fund Samruk-Kazyna, in November 2018 Kazatomprom was taken public with 15% of its shares placed on the Astana International Exchange and the London Stock Exchange.

International collaboration

Kazatomprom has forged major strategic links with Russia, Japan and China. It held a significant share in international company Westinghouse, but sold this in 2017. Canadian and French companies are involved with uranium mining and other aspects of the fuel cycle.

Russia

In July 2006 Russia and Kazakhstan (Kazatomprom) signed three 50:50 nuclear joint venture agreements totalling US$ 10 billion for new nuclear reactors, uranium production and enrichment. The first JV with Atomstroyexport is JV Atomniye Stantsii for development and marketing of innovative small and medium-sized reactors, starting with OKBM's VBER-300 as baseline for Kazakh units. Russia's Atomstroyexport expected to build the initial one.

The second JV with Tenex, confirmed in 2008, is for extending a small uranium enrichment plant at Angarsk in southern Siberia (this will also be the site of the first international enrichment centre, in which Kazatomprom has a 10% interest). It will eventually be capable of enriching the whole 6000 tonnes of uranium production from Russian mining JVs in Kazakhstan. See Fuel Cycle section below.

The uranium exploration and mining JVs Akbastau and Karatau with Tenex started with Budenovskoye in the Stepnoye area of south Kazakhstan, which commenced production in 2008. These complemented the Zarechnoye JV 250 km to the south which was set up in June 2006. However, in 2009 and 2010 the 50% ARMZ equity in these three was traded for an eventual 51% share of Canadian-based Uranium One Inc, which subsequently became wholly-owned by ARMZ. Uranium One Holdings (U1H) is now the holding company for all Russian uranium mining interests in Kazakhstan (and its equity in an acid plant).

In March 2011 Russia and Kazakhstan (Kazatomprom) signed stage II of this 2006 integrated cooperation program, involving uranium exploration and a feasibility study for a Kazakh nuclear power plant. Under this, and following JV development at Angarsk, Kazatomprom bought a 25% share of Russia's Novouralsk enrichment plant in 2013. (Separately, Kazatomprom has a 10% share in the International Uranium Enrichment Centre – IUEC – at Angarsk.)

At the end of May 2014 several agreements were signed between Rosatom and NAC Kazatomprom. One was a MOU for construction of a nuclear power plant using VVER reactors and with capacity up to 1200 MWe. It also involved fuel fabrication and nuclear waste management. A second agreement related to uranium mining at Kharasan-1, Akdala and South Inkai, where ARMZ has equity through Uranium One. A third agreement was a Comprehensive Development Program for Russia-Kazakhstan Cooperation in the Peaceful Uses of Atomic Energy, for nuclear power and fuel cycle matters.

Japan

In April 2007 a number of high-level agreements on energy cooperation were signed with Japan. These included some relating to uranium supply to Japan, and technical assistance to Kazakhstan in relation to fuel cycle developments and nuclear reactor construction. A further agreement on uranium supply and Japanese help in upgrading the Ulba fuel fabrication plant was signed in May 2008. Kazatomprom is keen to move from being a supplier of raw materials to selling its uranium as fabricated fuel assemblies. At the time it said that it aimed to supply 40% of the Japanese market for both natural uranium and fabricated fuel from 2010 – about 4000 tU per year. Negotiations then commenced for a bilateral nuclear cooperation agreement between Kazakhstan and Japan. In May 2011 a high-level intergovernmental agreement on developing nuclear energy was signed.

Earlier in August 2006 the Japan Bank for International Cooperation had signed an agreement with Kazatomprom to support and finance Japanese firms in developing Kazakh uranium resources to supply Japan's power generation. In April 2007 several Japanese companies – the Energy Asia consortium – bought 40% of the whole Kharasan mine project. Initially, Energy Asia comprised Marubeni 55%, Tepco 30%, Chubu 10% and Tohoku 5%. When Toshiba agreed to sell part of Westinghouse to Kazatomprom, it agreed to buy 9% of Kharasan from Marubeni (i.e. 22.5% of the Japanese stake). Then Kyushu Electric Power Co bought 2.5% of the Japanese stake, leaving Marubeni with 30%. The Energy Asia consortium share involved with both JVs (Kyzylkum and Baiken-U) became: Marubeni 30%, Tepco 30%, Toshiba 22.5%, Chubu 10%, Tohoku 5% and Kyushu 2.5%. In 2018 Kazatomprom bought a 40.05% share in Energy Asia (BVI) Ltd and a 16.02% share of Khorosan-U.

In March 2009 three Japanese companies – Kansai, Sumitomo and Nuclear Fuel Industries – signed an agreement with Kazatomprom on uranium processing for Kansai plants. In March 2010 a joint venture with Sumitomo was set up: Summit Atom Rare Earth Company, and in June, Kazatomprom and Toshiba agreed to set up a rare earth metals joint venture.

Earlier in September 2010, based on an April 2007 agreement, Japan Atomic Power Co, Toshiba and Marubini signed a technical cooperation agreement with the National Nuclear Centre (NNC) to study the feasibility of building nuclear power capacity. A further agreement to this end was signed in February 2013, between Japan Atomic Power Co (JAPC) and Marubini Utility Services, with NNC (see section below). At the same time an agreement between NNC and the Japan Atomic Energy Agency (JAEA) with JAPC concerned mining and processing of uranium and rare earth minerals. In October 2015 a further agreement between Kazatomprom, JAPC and Marubini Utility Services was signed, to develop cooperation on construction and financing of a nuclear power plant, involving consultations, exchange of experience in public communications, organization of technical workshops and meetings of experts on security and the training of staff.

In June 2012 and February 2013 R&D agreements between NNC and JAEA were signed relating to the design, construction and operation of the Kazakhstan high-temperature gas-cooled reactor (HTR) of about 50 MW at Kurchatov. This is flagged as a national project.

In June 2015 an agreement was signed between NNC and JAEA for stage 3 of a project to investigate sodium-cooled fast reactors in Kazakhstan.

China

In December 2006 China Guangdong Nuclear Power Group (CGNPC – now China General Nuclear Corporation, CGN) signed a strategic cooperation agreement with Kazatomprom. This was followed in May 2007 by an agreement on uranium supply and fuel fabrication, and in September 2007 by agreements on Chinese participation in Kazakh uranium mining joint ventures and on Kazatomprom investment in China's nuclear power industry. This is a major strategic arrangement for both companies, with Kazatomprom to become the main uranium and nuclear fuel supplier to CGN (accounting for a large share of the new reactors being built in China). In October 2008 a further agreement was signed covering cooperation in uranium mining, fabrication of nuclear fuel for power reactors, long-term trade of natural uranium, generation of nuclear electricity and construction of nuclear power facilities. In December 2014 a further agreement was signed with similar scope but focused on establishing a joint venture in Kazakhstan for the production of 200 t/yr of fuel assemblies. In December 2015 a further agreement was signed on the fuel fabrication project, to be at the Ulba Metallurgical Plant (see Fuel cycle: front end section below). A CGN subsidiary, Sino-Kazakhstan Uranium Resources Investment Co, has invested in two Kazakh uranium mines, Irkol and Semizbai, through the Semizbai-U LLP joint venture. In 2015 CGN Mining Co bought the 49% Chinese equity in Semizbai-U.

A framework strategic cooperation agreement was signed with China National Nuclear Corporation (CNNC) in September 2007 and this was followed in October 2008 with another on "long-term nuclear cooperation projects" under which CNNC was to invest in a uranium mine. Late in 2007 Kazatomprom signed an agreement with both GCNPC (now CGN) and CNNC for them to take a 49% stake in two uranium mine joint ventures and supply 2000 tU per year from them. In February 2011 CNNC signed a contract to buy 25,000 tU.

Early in 2009 Kazatomprom signed an agreement with CGNPC for establishment of a specialized company for the construction of nuclear power plants in China, since Kazakh plans to work with Russia's Atomstroyexport developing and marketing innovative small and medium-sized reactors had been put on hold. In mid-2009 a feasibility study on this joint CGNPC project was under way, but no more has been heard since. In December 2015 both governments announced the establishment of a $2 billion fund for bilateral projects within the framework of the 'New Silk Road', now Belt & Road Initiative (BRI), the new Chinese investment programme. CGN worked with Kazatomprom to build the Ulba-FA fuel fabrication plant, which began construction in 2016 and was completed in 2020.

At the end of August 2015, among $23 billion of China-Russia deals, JSC Samruk-Kazyna, the national holding company owning NAC Kazatomprom, signed deals worth $5 billion with Chinese companies, and Kazatomprom agreed on transit of its products via China to North America.

In November 2021 Kazatomprom announced two contracts for the supply of natural uranium concentrate to China: one with China National Uranium Company Limited; and the other with State Nuclear Uranium Resources Development Company Limited.

India

In January 2009 Kazatomprom signed an agreement with India's Nuclear Power Corporation (NPCIL) to supply 2100 tonnes of uranium to India and undertake a feasibility study on building Indian PHWR reactors in Kazakhstan. NPCIL said that it represented "a mutual commitment to begin thorough discussions on long-term strategic relationship."

In July 2015 Kazatomprom signed an agreement with India's Department of Atomic Energy to supply 5000 tU to India over the period 2015-2019.

South Korea

The Kazakh Industry and Trade Ministry has held talks with South Korea's Korea Electric Power Corporation (Kepco) on uranium mining and nuclear power plant construction in Kazakhstan, apparently on Kepco's initiative.

In April 2010 Kazakhstan signed a nuclear cooperation agreement with South Korea, paving the way for export of Korean SMART 100 MWe nuclear reactors and for joint projects to mine and export Kazakh uranium.

Toshiba

At the corporate level, in 2007 Kazatomprom purchased a 10% share in Westinghouse. Toshiba had bought the company from BNFL for $5.4 billion early in 2006, and The Shaw Group then took 20% and IHI Corp. 3%. Toshiba originally envisaged holding only 51%, and this deal reduced its holding to 67%. The Kazatomprom link strengthened the company's upstream links for fuel supplies, and was to enhance its marketing of nuclear reactors (the vendor usually supplies the first core for a new reactor, and ongoing fuel services may be offered in addition). It also brought Kazatomprom more fully into the industry mainstream, with fuel fabrication in particular. However, in 2017 Kazatomprom exercised its option to require Toshiba to buy its share for $522 million

The Westinghouse link led to a decision to set up with Toshiba a nuclear energy institute in the northeastern town of Kurchatov, near Semipalatinsk, which is already a centre of R&D activity. This was announced by Kazatomprom and the Kazakh prime minister in September 2008 and was to focus on skills development in all aspects of the nuclear fuel cycle as well as reactor technology. Three research reactors are operated by the Institute of Atomic Energy at Kurchatov.

Canada, Cameco

In May 2007 Canada's Cameco Corporation signed an agreement with Kazatomprom to investigate setting up a uranium conversion plant, using its technology, and also increasing uranium production at its 60% owned Inkai mine.

In May 2016 Cameco and Kazatomprom agreed to restructure the Inkai JV, extending it to 2045 but with Cameco becoming a minority owner, with 40%. Production is to be ramped up to 4000 tU per year. The restructuring took effect from 1 January 2018.

Earlier in June 2008 Cameco and Kazatomprom announced the formation of a new company – Ulba Conversion LLP – to build a 12,000 t/yr uranium hexafluoride conversion plant at the Ulba Metallurgical Plant (UMZ) in Ust-Kamenogorsk. Cameco would provide the technology and hold 49% of the project. A preliminary feasibility study was undertaken jointly by Kazatomprom and UMZ, then the project was put on hold. A May 2016 agreement grants Kazatomprom a five-year option to license Cameco's uranium conversion technology for constructing and operating a uranium conversion plant in Kazakhstan.

In December 2013, a prefeasibility study (PFS) for a uranium refinery in Kazakhstan was completed, to produce UO3 for further processing in Canada. The project will require government approvals for the transfer of Cameco’s proprietary uranium refining technology from Canada. In January 2014 the government referred to the proposed plant as a ‘strategic goal’, and in May 2016 the two companies agreed to complete a feasibility study on a uranium refinery producing 6000 tU per year as UO3. This would initially be owned 71.67% by Kazatomprom and 28.33% by Cameco, and Cameco's interest in JV Inkai would increase from 40% to 42.5% on commissioning of the refinery. Should the refinery be built, Kazatomprom will also be given an option to obtain UF6 conversion services at Cameco's Port Hope facility and to receive other commercial support from Cameco, whose equity in both operations might increase slightly as a result.

USA, Centrus, Converdyn

In October 2015 Kazatomprom signed an agreement with Centrus Energy to help market Kazakh uranium in the USA.

In April 2016 Kazatomprom signed an agreement with US-based Converdyn so that Kazatomprom could offer uranium for sale in the form of natural UF6, and access new markets with an “integrated product offering”, giving customers “increased supply options”. This is simply a marketing alliance, complementary to the Cameco investment in Ulba.

Also in April a Kazakh-US energy partnership agreement was signed, related to nuclear security and in particular the “conversion of Kazakhstan's research reactors and enforcement of physical nuclear security."

Areva (now Orano)

In June 2008 Areva signed a strategic agreement (MOU) with Kazatomprom to expand the existing Katco joint venture from mining 1500 tU/yr to 4000 tU/yr (with Areva handling all sales), to draw on Areva's engineering expertise in a second JV (49% Areva) to install 1200 tonnes per year fuel fabrication capacity at the Ulba Metallurgical Plant, and in a third JV (51% Areva) to market fabricated fuel.

In October 2009 the two parties signed another agreement to establish the IFASTAR joint venture (Integrated Fuel Asia Star – 51% Areva) to establish the feasibility of marketing an integrated fuel supply for Asian customers (i.e. selling the enriched and fabricated fuel, not simply Kazakh uranium or Areva front-end services), and of building a 400 t/yr nuclear fuel fabrication line at the Ulba plant. IFASTAR is to be based in Paris, and would market the fuel.

In October 2010 an agreement was signed to set up a joint venture company (51% Kazatomprom) to build a 400 t/yr fuel fabrication plant based on an Areva design at the Ulba Metallurgical Plant, starting operation by 2014. In November 2011 a further agreement was signed in relation to the plant. In March 2016 Areva was awarded a contract for equipment and support to the Ulba-FA plant for the fabrication of 200 t/yr of fuel assemblies for China General Nuclear Corp (CGN) reactors. Construction of the plant began in 2016, and commissioning and licencing were completed in 2020. The plant opened in November 2021. It was built by a Kazatomprom-CGN joint venture.

Earlier in April 2017 a further agreement with Areva was signed to give the Katco joint venture a new long-term perspective, with the development of the South Tortkuduk project. In August 2022 Orano announced that Katco had signed a new mining permit with the Ministry of Energy of Kazakhstan to develop the Tortkuduk parcel of the South Tortkuduk deposit. The company said production was scheduled to start in 18 months.

Iran

In March 2017 Kazatomprom contracted to supply 950 t of uranium concentrate to Iran over three years, subject to agreement by the UN Security Council.

Mines

At a corporate and project level in mining, the following table summarizes international equity links:

| Company, project or mine | Foreign investor and share | Value of share or project if known |

| Inkai JV (Inkai mines) | Cameco 40% | |

| Betpak Dala JV (South Inkai, Akdala mines) | Uranium One 70% | $350 million for 70% in 2005 |

| Appak JV (W.Mynkuduk) | Sumitomo 25%, Kansai 10% | $100 million total in 2006 |

| JV Karatau (Budenovskoye 2 deposit) | Uranium One 50% (bought from ARMZ in 2009) | 117 million Uranium One shares (giving 19.9% ownership) + $90 million |

| Akbastau JSC (Budenovskoye 1, 3, 4 deposits) | Uranium One 50% (bought from ARMZ in 2010) | |

| Zhalpak | CNNC 49% | |

| Katco JV (Moinkum, Tortkuduk mines) | Orano 51% | $110 million in 2004 |

| Kyzylkum JV now Khorosan-U (Kharasan 1 mine) | Uranium One 30%, Energy Asia (Japanese + 40.05% Kazatomprom) 20% | $75 million in 2005 for 30%, $430 million total in 2007 (both mines) |

| Baiken-U JV (Kharasan 2 mine) | Energy Asia (Japanese + 40.05% Kazatomprom) 47.5% | $430 million total in 2007 (both mines) |

| Semizbai-U JV (Irkol, Semizbai mines) | CGN 49%, also CNEIC | |

| Zarechnoye JSC (Zarechnoye & S.Zarechnoye mines) | Uranium One 49.67% (bought from ARMZ in 2010), Krygyzstan 0.66% | ARMZ paid $60 million total |

Early in 2012 Kazatomprom announced that it would increase its share in mining activities nationally from 46% to 51% by buying out Japanese (and possibly some Uranium One) equity in the Kyzylkum and Baiken-U JVs, where it held 30% and 5% respectively. Both JVs are mining the Kharasan deposit in the western part of Syrdarya province. In 2014 Khorosan-U was set up by Kazatomprom to take over from Kyzylkum the mining of Kharasan 1 in JV with Energy Asia (36%) and Uranium One (30%). In 2018 Kazatomprom's ownership of the Baiken-U, Kyzylkum and Khorosan-U joint ventures became 52.5%, 50% and 50% respectively after it bought a 40.05% share in Energy Asia (BVI) Ltd and a 16.02% share of Khorosan-U.

Earlier in 2009 investigations were launched into how, and at what prices, certain Kazakh entities came to hold title to particular mineral deposits before those rights were sold to international investors, particularly some of those above. In June 2009 Kazatomprom reassured its foreign joint venture and equity partners in uranium mining, from Japan, Russia, Canada, France and China that existing arrangements with foreign partners would not be changed, despite criminal charges being laid against former Kazakh executives.

The transfer to Uranium One of ARMZ's half shares in Akbastau and Zarechnoye (valued at $907.5 million) in 2010 involved payment by ARMZ of $610 million in cash (at least $479 million of which would be paid directly to shareholders – other than ARMZ – as a change of control premium) and ARMZ increasing its shareholding in Uranium One from 23% to at least 51.4% through a share issue. It subsequently took over the whole company.

Uranium trading

In April 2017 Kazatomprom announced the formation of a Swiss-based trading subsidiary TH Kazatom, to bring greater liquidity to the uranium market from late in the year. It will buy and sell on the spot market as part of its corporate transformation to align its pricing mechanism with “the way our customers want to buy”, especially in European and US markets.

In 2018 the Trans-Caspian International Transport Route was developed due to the Port of St Petersburg being temporarily unavailable to Class 7 nuclear material when the city hosted the 2018 FIFA World Cup competition. The route, which doesn’t cross Russian territory, was since maintained by Kazatomprom to provide an alternative uranium delivery route. The route passes through Azerbaijan and Georgia, so shipments must meet the requirements of the transit authorities in those countries. Although Kazatomprom's shipments have continued to pass through St Petersburg with no restrictions, early in 2022, Cameco put deliveries of Kazakh uranium on hold until an alternative route avoiding Russian railway lines or ports could be finalized.

In September 2022 Kazatomprom dispatched a uranium delivery for Cameco via the Trans-Caspian International Transport Route to Canada. The shipment arrived in Canada in December 2022.

Uranium mining

Uranium exploration started in 1948 and economic mineralization was found is several parts of the country and this supported various mines exploiting hard rock deposits. Some 60 uranium deposits are known, in six uranium provinces. According to the 2022 Red Book, reasonably assured uranium resources were 367,800 tU and inferred resources 447,500 tU to $130/kgU.

In 1970 tests on in situ leach (ISL) mining commenced and were successful, which led to further exploration being focused on two sedimentary basins with ISL potential.

In-situ leaching is a low-impact method of mining (Kazatomprom)

Up to 2000 twice as much uranium had been mined in hard rock deposits than sedimentary ISL, but almost all production is now from ISL. Uranium production dropped to one-quarter of its previous level 1991 to 1997, but has since increased greatly.

Kazakh Uranium Production

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Tonnes U | 21,317 | 22,451 | 23,127 | 23,607 | 24,586 | 23,321 | 21,705 | 22,808 | 19,477 | 21,819 | 21,227 | 21,112 |

|---|

Source: Kazatomprom

* In April 2020 Kazatomprom said production volumes in 2020 would decrease by up to 4000 tU as a result of measures taken in response to the coronavirus pandemic.

In 2009 Kazakhstan became the world's leading uranium producer, with almost 28% of world production, then 33% in 2010 rising to 43% in 2019.

In January 2017, Kazatomprom announced a 10% cut in planned production for 2017. Then, in December 2017, it announced a 20% cut in planned production over three years, starting from January 2018. The company said that the revised production plan was to better align with demand. However in February 2019, the Kazakhstan Ministry of Energy announced that production would increase by 5% in 2019 to about 22,800 tU. 2020 production was expected to be similar to 2019, but may now be up to 4000 tU lower as a result of measures taken to comply with lockdown requirements due to the coronavirus pandemic. In August 2020, Kazatomprom stated that it expects to produce 22,000-22,500 tU in both 2021 and 2022.

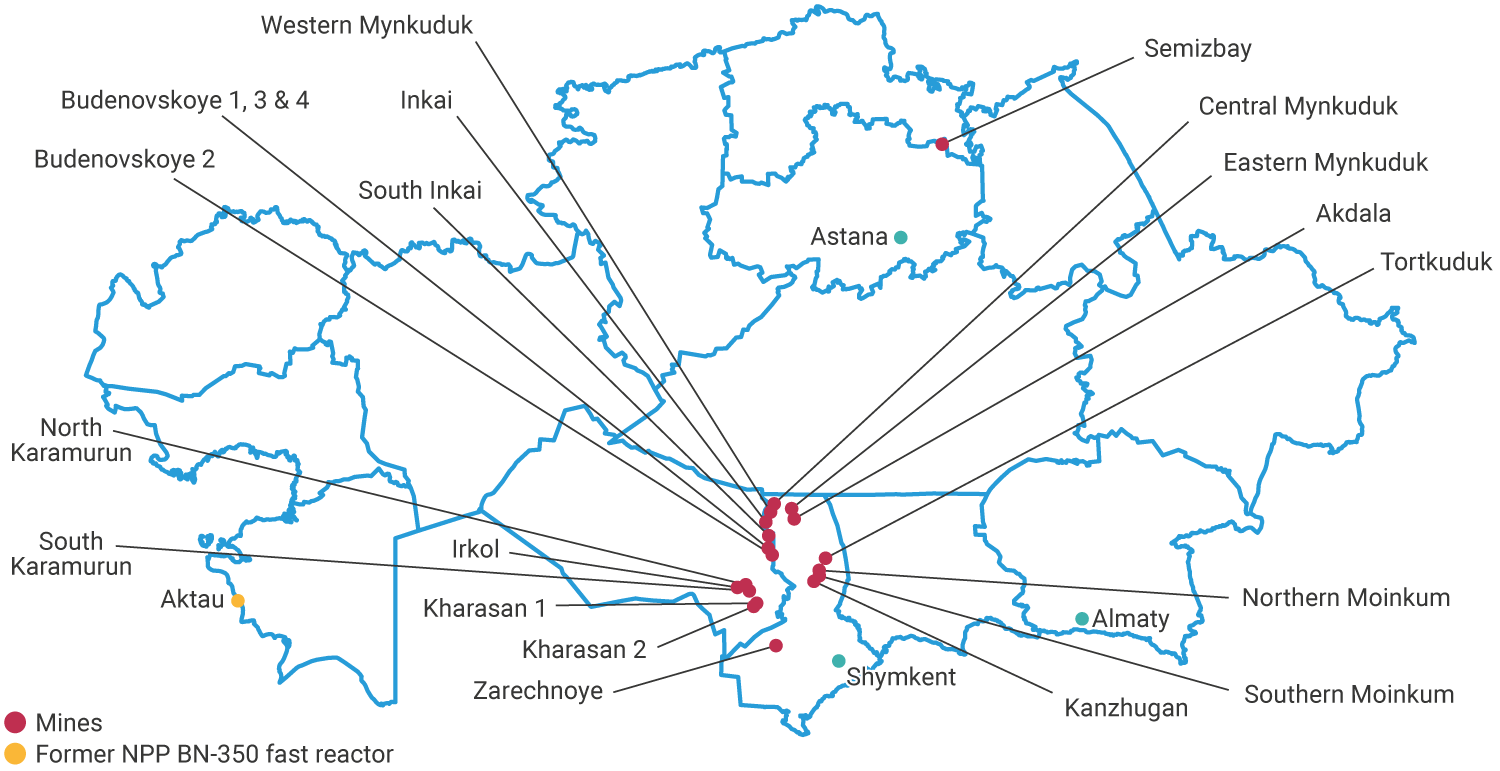

Uranium mines and former nuclear power plant in Kazakhstan

Kazakh Uranium Production by Mines (tonnes U)

| Province and Group | Mine | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Chu-Sarysu, Eastern | Tortkuduk & northern Moinkum (Katco) | 3661 | 3558 | 4322 | 4007 | 4003 | 3519 | 3339 | 3252 | 2833 | 2840 | 2564 |

| Southern Moinkum & Kanzhugan (Taukent/GRK) | 1075 | 1129 | 1174 | 873 | 781 | 616 | 609 | 1541 | 1230 | 1493 | 1273 | |

| Chu-Sarysu, Northern | Uvanas & Eastern Mynkuduk (Stepnoye-RU/GRK) |

1234 | 1192 | 1154 | 1341 | 1222 | 974 | 866 | 0 | 0 | 0 | 0 |

| Central Mynkuduk (Ken Dala.kz) | 1622 | 1800 | 1790 | 1770 | 1953 | 1898 | 1600 | 1694 | 1308 | 1579 | 1650 | |

| Western Mynkuduk (Appak) | 1003 | 998 | 870 | 880 | 1004 | 901 | 839 | 800 | 633 | 805 | 830 | |

| Inkai 1, 2, 3 (Inkai) | 1701 | 2047 | 1922 | 2418 | 2413 | 2202 | 2643 | 3209 | 2693 | 3449 | 3201 | |

| Inkai 4 (South Inkai) | 1870 | 2030 | 2002 | 2007 | 2058 | 2037 | 1617 | 1601 | 2260* | 2321* | 2225* | |

| Akdala (Betpak Dala) | 1095 | 1020 | 1007 | 1042 | 1000 | 900 | 835 | 800 | 2260* | 2321* | 2225* | |

| Budyonovskoye 1, 3 & 4 (Akbastau) | 1203 | 1499 | 1594 | 1630 | 1778 | 1941 | 1561 | 1550 | 1363 | 1545 | 1545 | |

| Budyonovskoye 2 (Karatau) | 2135 | 2115 | 2084 | 2064 | 2108 | 2359 | 2081 | 2600 | 2460 | 2561 | 2560 | |

| Syrdarya, Western | North and South Karamurun (GRK) | 1000 | 1000 | 941 | 956 | 1015 | 718 | 819 | 864 | 660 | 800 | 830 |

| Irkol (Semizbai-U) | 750 | 750 | 700 | 781 | 700 | 678 | 560 | 960 | 753 | 962 | 940 | |

| Kharasan 1 (Kyzylkum, now Khorosan-U) | 583 | 752 | 858 | 1095 | 1354 | 1564 | 1554 | 1599 | 1455 | 1579 | 1580 | |

| Kharasan 2 (Baiken-U) | 603 | 888 | 1135 | 1503 | 1838 | 1762 | 1666 | 1560 | 1181 | 1230 | 1315 | |

| Syrdarya, Southern | Zarechnoye (Zarechnoye) | 942 | 931 | 876 | 800 | 817 | 802 | 781 | 778 | 648 | 655 | 741 |

| Northern, Akmola region | Semizbay (Semizbai-U) | 470 | 411 | 400 | 440 | 542 | 450 | 377 | 0 | 0 | 0 | 0 |

| RU-1 (Vostok, Zvezdnoye) | 370 | 331 | 298 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| TOTAL | 21,317 | 22,451 | 23,127 | 23,607 | 24,586 | 23,321 | 21,765 | 22,808 | 19,477 | 21,819 | 21,227 |

Some figures estimated.

* Combined production of SMCC JV (Inkai 4 and Akdala) - figures not provided by mine.

The last surviving underground mines at Grachev and Vostok in the Northern province had been operating since 1958 and are now rather depleted. KazSabton operated them, having taken over from Tselinny Mining & Chemical Co (TGK) in 1999. It treated the ore at the Stepnogorsk mill, yielding some 250 tU per year. Production from the Stepnogorsk Mining & Chemical Complex plant at some 300 tU/yr has been the only non-ISL production, but the mine was reported to be shut down in 2015. The Semizbai ISL project is also in the Northern province, Akmola region, and Semizbai-U was formed in 2006 to mine it.

In the Balkash province some mining of volcanogenic deposits occurred during the Soviet era. In the Ili province east of this there is some uranium in coal deposits.

In the Caspian province the Prikaspisky Combine operated a major mining and processing complex on the Mangyshalk Peninsula in the 1960s and this led to the founding of Aktau. It was privatized as Kaskor in 1992 and operations ceased in 1994.

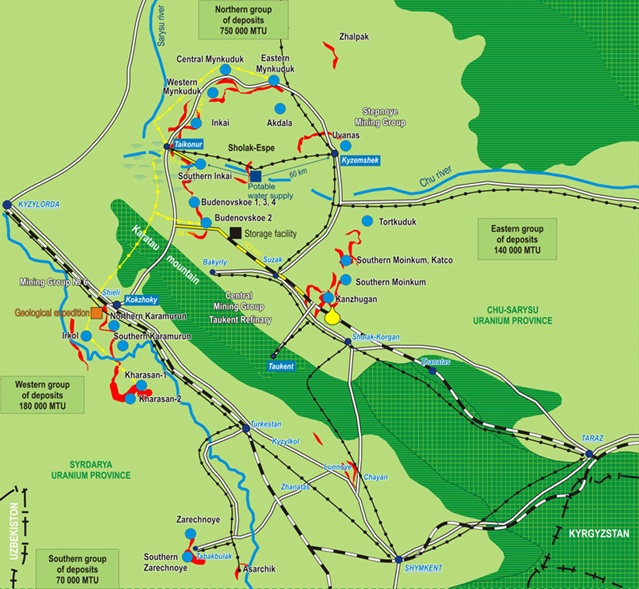

Map from Kazatomprom, 2007

All except one of the operating and planned ISL mine groups are in the 40,000 square kilometre Chu-Sarysu province in the central south of the country and controlled by the state corporation Kazatomprom. Mines in the Stepnoye area have been operating since 1978, some in the Tsentralnoye area since 1982 – both in the Chu-Sarysu basin/uranium district, which has more than half the country's known resources. It is separated by the Karatau Mountains from the Syrdarya basin/uranium district to the south, where mines in the Western (No.6) area have operated since 1985. All have substantial resources.

The ISL mines and projects in the two central southern provinces are in four groups, as set out below. Production costs from these are understood to be low. Mining is at depths of 100-300 metres, though some orebodies extend to 800 metres. Uranium One in September 2007 was quoting "cash cost" figures of $8.00 to $10.50/lb for three mines it is involved with, though these may not include wellfield development and current figures are quoted below. A further feature of Kazakh uranium mining is that Kazatomprom plans to establish new mines in three years, compared with twice this time or more in the West, due to regulatory hurdles.

Inkai is the largest ISL mine, and Cameco's description of its operation is: Uranium occurs in sandstone aquifers as coatings on the sand grains at a depth of up to 300 metres. Uranium is largely insoluble in the native groundwater which is not potable due to naturally high concentrations of radionuclides and dissolved solids. Using a grid of injection and production wells, a mining solution containing an oxidant (sulfuric acid) is circulated through the orebody to dissolve the uranium. The uranium-bearing solution (generally containing less than 0.1% uranium) is then pumped to a surface processing facility where the uranium is removed using ion exchange resin. The water is re-oxidized and re-injected into the orebody. The uranium is stripped from the resin, precipitated with hydrogen peroxide and then dried to form the final product, U3O8. This process is repeated to remove as much uranium as is economically feasible. When mining at the site is complete, the groundwater will be restored to its original quality.

This is a closed loop recirculation system since the water from the production well is reintroduced in the injection wells. Slightly less water is injected than is pumped to the surface to ensure that fluids are confined to the ore zones intended for extraction. Monitor wells are installed above, below and around the target zones to check that mining fluids do not move outside a permitted mining area.

Taxation

Mineral extraction taxes are incurred and paid by mining entities in Kazakhstan. Effective 1 January 2023 the tax is set at 6%. Starting 1 January 2025 the applicable rate rises to 9% for 2025 only. From 2026 onwards the tax rate paid will vary based on the amount mined as follows:

| Production | Tax rate, % |

|---|---|

| Up to and including 500 tonnes | 4% |

| Up to and including 1000 tonnes | 6% |

| Up to and including 2000 tonnes | 9% |

| Up to and including 3000 tonnes | 12% |

| Up to and including 4000 tonnes | 15% |

| Above 4000 tonnes | 18% |

The tax rate from 2026 onwards will also increase in the event that the price of U3O8 in a reporting period exceeds certain thresholds:

| Weighted average U3O8 price | Additional tax rate, % |

|---|---|

| Above $70/lb | 0.5% |

| Above $80/lb | 1.0% |

| Above $90/lb | 1.5% |

| Above $100/lb | 2.0% |

| Above $110/lb | 2.5% |

Acid production

ISL uranium production in Kazakhstan requires large quantities of sulfuric acid*, about 1.5 million tonnes per year (according to Argus Media), due to relatively high levels of carbonate in the orebodies. A fire at a sulfuric acid production plant in 2007 led to shortages, and due to the delayed start-up of a new plant, rationing continued until mid-2008. Extra supplies were sought from Uzbekistan and Russia, but uranium production well into 2009 was affected. Uranium One revised its 2008 production downwards by 1080 tU, which it said was "primarily due to the acid shortage" for its South Inkai and Kharasan 1 projects (70% and 30% owned respectively) which were just starting up. In August 2009 Cameco reported that production at Inkai would remain constrained through 2009 due to acid shortage.

* 70-80 kg acid/kgU (comprising 15-20% of the operating expense), compared with Beverley and Four Mile in Australia at around 3 kg/kgU.

At Balkhash a 1.2 million t/yr Canadian acid plant feeding from the Kazakhmys Corporation copper smelter started production at the end of June 2008, financed by an EBRD loan to abate sulfur dioxide emissions from copper smelting. Another Kazakhmys metallurgical acid plant is at Zhezkazgan, with unknown capacity and old plant may not be operational.

A 180,000 t/yr Italian-built acid plant at the Stepnogorsk Mining and Chemical Combine costing $74 million was commissioned in 2015 to serve ISL mining. A 360,000 t/yr acid plant at Stepnogorsk started in 2008 but has apparently been shut down for environmental reasons.

Another new acid plant of 500,000 t/yr capacity, was commissioned in December 2011 at Zhanakorgan, next to the Kharasan mines in the Western (#6) mining group or Kyzlorda region, to serve those mines from 2011, reaching design capacity in 2012. In 2013 it produced 356,600 t of acid and 16.9 MWh of power. At full capacity it burns 170,000 t/yr of solid sulfur derived from oil and gas production by Tengizhevroil in western Kazakhstan. This is the SKZ-U LLP/SAP-U* joint venture, with Kazatomprom (49%), Japanese interests (32%) and Uranium One (19%). It is a US$ 216 million project, and supplies all the Western region mines: Kharasan, Irkol and Karamurun.

* Construction of the plant was being carried out by SKZ-U LLP joint venture, in which Baiken-U LLP (40%) and Kyzylkum LLP (60%) are the stakeholders. Uranium One declares a 19% "joint control interest" in SKZ-U from 2009.

KazZinc has a 320,000 t/yr metallurgical acid plant operating since 2004 at Ust-Kamenogorsk Metallurgical Complex, taking gas from a zinc roaster and lead smelter, and another of unknown capacity operating there since 2011, taking gas from an IsaSmelt lead furnace. Both are primarily to abate sulfur dioxide emissions from smelting.

A further acid plant of 180,000 t/yr capacity is planned in connection with the Pavlodar Oil Refinery in northeast Kazakhstan, using 60,000 t/yr of sulfur from the refinery.

In 2009 Kazatomprom with other mining companies and two acid producers, KazZinc JSC and Kazakhmys, set up a coordinating council to regulate acid supplies and infrastructure. Cameco reported that acid supply was adequate through 2010.

Kazakh ISL uranium mines

| Region | ISL mine | Resources tU |

Operator | Annual production target tU/yr |

Start production, full production |

| Chu-Sarysu Province, Chu-Sarysu district | |||||

| Northern/Stepnoye group | Uvanas |

8100

|

Stepnoye-RU LLP (K'prom) |

400

|

2006

|

| East Mynkuduk | 22,000 | 1300 | 2006, 2007 | ||

| Inkai 1, 2, 3 |

Reserves 104,000 tU, plus 12,300 tU measured & indicated resources and 29,000 tU inferred

|

Inkai JV to 2017: Cameco 60%, K'prom 40%. From 2018: Cameco 40%, K'prom 60% |

2500 in 2017,

4000 later |

2008, 2010, 2019 for expansion

|

|

| South Inkai (Inkai 4) |

Reserves 13,000, in 15,260 indicated,

17,100 inferred |

BetpakDala JV: Uranium One 70%, K'prom 30% |

2000

|

2007, 2011

|

|

| Akdala |

10,359 total

|

1000

|

2006, 2007

|

||

| Central Mynkuduk (Mynkuduk) |

52,000

|

JSC Ken Dala.kz Stepnogorsk (K'prom), Production Enterprise Ortalyk from 2011 |

2000

|

2007, 2010

|

|

| West Mynkuduk |

26,000

|

Appak JV: K'prom 65%, Sumitomo 25%, Kansai 10% |

1000

|

2008, 2010

|

|

| Akbastau (Budenovskoye 1, 3, 4) |

31,600 reserves, in 47,293 resources

|

JV Akbastau: K'prom 50%, Uranium One 50% |

1000 (1)

2000 (3,4) |

2009, 2015

2010 |

|

| Karatau (Budenovskoye 2) | 52,000 reserves, in 64,000 resources | JV Karatau: K'prom 50%, Uranium One 50% | 2000 (to 3000) | 2008, 2011 | |

| Zhalpak |

15,000

|

Ortalyk LLP (K'prom) |

500-1000

|

?

|

|

| Central/Eastern (Tsentralnoye) group | Tortkuduk (Moinkum North) |

24,000

|

Katco JV, Areva 51%, K'prom 49% |

2500

|

2007, 2008

|

| Moinkum* (southern Moinkum, Katco) - northern |

in above

|

1500

|

2006, 2007

|

||

| South Moinkum

(east Moinkum) |

35,000

|

Taukent Mining & Chemical Plant LLP (K'prom) |

1500

|

2006

|

|

| Kanzhugan / Kaynarski |

22,000

|

600

|

2008

|

||

| Chu-Sarysu Province, Syrdarya district | |||||

| Western (no.6) group | Kharasan 1 (north) | 15,693 plus 17,940 inferred | Khorosan-U JV, Energy Asia 40%, Uranium One 30%, K'prom 30% | 3000 | 2010, 2014 |

| Kharasan 2 (south) | ? | Baiken-U JV, Energy Asia 95%, K'prom 5% |

2000

|

2010, 2014

|

|

| Irkol |

30,000

|

Semizbai-U JV (K'prom 51%, CGN Mining 49%) |

750

|

8/2008, 2010

|

|

| N. Karamurun | 16,000 | Mining Group 6 LLP (K'prom) | 1000 | 2007, 2010 | |

| S. Karamurun |

18,000

|

Mining Group 6 LLP (K'prom) | 250 | 2009 | |

|

Southern group |

Zarechnoye |

12,500 plus 4500 inferred

|

Zarechnoye JV: K'prom 49.67%, Uranium One 49.67% | 1000 | 2007, 2012 |

| Southern Zarechnoye | "insufficient to support development" | 600 | deferred | ||

| Northern Province | |||||

| Akmola region | Semizbai | Semizbai-U JV (K'prom 51%, CGN Mining 49%) | 700 | 2009, 2011 | |

Kazatomprom mining subsidiaries and joint ventures

| Company or JV | Mines |

| Mining Company LLP (GRK) (Stepnoye-Ru LLP, Mining Group No.6 LLP) |

Uvanas East Mynkuduk North & South Karamurun |

| Ortalyk LLP/Ken Dala.kz JSC | Central Mynkuduk |

| GRK: Taukent Mining-Chemical Plant LLP | Kanzhugan South Moinkum |

| Katco JV (with Areva 51%) | South Mynkuduk Moinkum 1&2 Tortkuduk |

| Inkai JV (with Cameco 40%) | Inkai 1, 2, 3 |

| Zarechnoye JV (with Uranium One 49.67%) | Zarechnoye South Zarechnoye |

| APPAK JV (with Sumitomo 25% & Kansai 10%) | West Mynkuduk |

| Betpak Dala JV (with Uranium One 70%) | Akdala South Inkai |

| Karatau JV (with Uranium One 50%) | Karatau/Budenovskoye 2 |

| Akbastau JV (with Uranium One 50%) | Akbastau/Budenovskoye 1, 3, 4 |

| Kyzylkum JV (with Uranium One 30% & Energy Asia 40%), now Khorosan-U JV |

(North) Kharasan 1 |

| Baiken-U JV (with Energy Asia 95%) | (South) Kharasan 2 |

| Semizbai-U JV (with CGN 49%) | Semizbai Irkol |

| Ortalyk LLP | Zhalpak |

Kazatomprom has increased its interest in the Baiken-U, Kyzylkum and JV Khorasan-U uranium joint ventures to 52.5%, 50% and 50%, respectively, through transactions completed during the first half of 2019.

The mines and regions

Stepnoye or Northern mining group

The Stepnoye or Northern mining group in the Chu-Sarysu basin consists of Uvanas, East Mynkuduk, Akdala and Inkai mines, with Central and West Mynkuduk, South Inkai, Budenovskoye and Zhalpak planned. All are amenable to in-situ leaching (ISL).

Uvanas is a small deposit which commenced operation in 2006.

Inkai was discovered in 1976, and the Inkai Joint Venture (JVI) developed the Inkai mine in this part of the Chu-Sarysu basin and holds rights to blocks 1,2&3. JVI was set up in 1996 (then including Uranerz), and to the end of 2017 Cameco held 60% with Kazatomprom (40%). Following a two-year feasibility study completed in 2004, and regulatory approval in 2005, JVI started commercial production from ISL in 2008 and ramped up to 2000 tU/yr from blocks 1&2 – 2013 production was 1900 tU. Eventual production is envisaged as 4000 tU/yr from all three blocks, and plans for this are agreed, involving a change of ownership from 2018 to 40% Cameco and 60% Kazatomprom with lease extension to 2045 from all three blocks. The agreement is linked to that for a uranium refinery, and Cameco’s interest in JV Inkai could increase later to 44%.

JVI is developing block 3, and in 2015 started operation of the test wellfields there and began uranium production with the test leach facility. Production is not yet included in the JV totals.

Capital cost of the JVI development for the remaining life of current reserves at the end of 2016 was quoted at $297 million. The main processing plant on block 1 has an ion exchange capacity of 1040 tU/yr and a product recovery capacity of 3100 tU/yr. A satellite 2400 tU/yr IX plant is on block 2, and a test leach facility on block 3. Cameco earlier reported for blocks 1&2: 36,600 t U3O8 proven and probable reserves at 0.057% grade and 39,000 t U3O8 inferred resources. Operating cost over the life of the mine is estimated to be $12.71/lb U3O8. Cameco considers that block 3 “has the potential to support a commercial operation” but does not quote resource figures (end 2016, NI 43-101 technical report). Cameco in December 2017 reported a total of 103,725 tU proven and probable reserves at 0.027% U grade for Inkai, plus 12,334 tU measured and indicated resources at 0.021% grade and 28,900 tU inferred resources.

In September 2005 UrAsia Energy Ltd of Canada agreed to pay $350 million for 70% of the Betpak Dala joint venture which owns the South Inkai project and the Akdala mine. The company (UrAsia) is now Uranium One Inc.

South Inkai mine started trial production in 2007 and was ramping up to expected 1900 tU/yr in 2011. Commercial production officially began in January 2009, and in that year 830 tU was produced. Cash operating cost in 2009 was $21/lb of concentrate, expected to drop to $19 in 2013, though significant capital requirement remains then.

South Inkai in mid-2013 had 5641 tU measured and indicated resources, 5077 tU proven and probable resources and 17,099 tU inferred resources. Average grade is 0.015%, 0.010% and 0.040% respectively. Uranium One projected average cash cost of production for 2014 as $18/lb U3O8.

Akdala started up in 2006 and produced 1031 tU in 2008 and 1046 tU in 2009, at cash operating cost of $14/lb of concentrate, expected to increase to $15 in 2013. In two orebodies Akdala in mid-2013 has 2286 tU measured & indicated resources, and 2058 tU proven & probable resources. Inferred resources are 6015 tU. Uranium One projected average cash cost of production for 2014 as $16/lb U3O8.

Central Mynkuduk mine started up in 2007 and was expected to reach capacity of 2000 tU/yr by 2010. It is operated by the Ken Dala.kz joint stock company, part of Kazatomprom (has been reported as Ortalyk LLP). In December 2020 it was reported that CGN had agreed with Kazatomprom to purchase 49% of shares in Ortalyk; this was confirmed in April 2021. Ortalyk also owns the Zhalpak uranium deposit.

Production of yellowcake at Central Mynkuduk (Kazatomprom)

West Mynkuduk: Early in 2006 KazAtomProm signed a $100 million joint venture agreement with Sumitomo Corp (25%) and Kansai Electric Power Co (10%) to develop the deposit. First production from the Appak JV was in June 2008 with design capacity of 1000 t/yr expected in 2010. Sumitomo will supply uranium from the mine to Japanese power utilities.

The East Mynkuduk mine was launched in May 2006 by Kazatomprom to achieve its planned 1000 t/yr production in 2007.

The Karatau mine at the south end of the Budenovskoye deposit started production in 2008 (655 tU), and ramped up to a capacity of 2000 tU/yr by 2011. Capacity of the Budenovskoye 2 uranium recovery plant reached 3000 tU/yr in 2011, serving both Karatau and Akbastau. Karatau in mid-2013 had reserves of 52,000 tU in measured and indicated resources of 63,839 tU and proven and probable resources of 51,960 tU. Average resource grade is 0.074% and 0.035% respectively. Uranium One projected average cash cost of production for 2014 as $11/lb U3O8. In 2016 wells were drilled to 700 metres and production tests commenced.

The Akbastau mine (Budenovskoye 1, 3, 4) just north of this started production at the end of 2009 and produced 385 tU that year, with recovery from pregnant liquor being at Karatau. It expected almost 1000 tU production in 2011 and ramping up to 3000 tU/yr by 2015, with $200 million being spent to achieve that. Akbastau 1-3 in mid 2013 have reserves of 31,600 tU, in combined measured and indicated resources of 47,293 tU, and proven and probable resources of 31,598 tU. Uranium One projected average cash cost of production for 2014 as $13/lb U3O8.

In July 2006 both Budenovskoye operations became 50:50 JVs with Russia, complementing Zarechnoye, but in 2009 ARMZ's share in Karatau was sold to Uranium One. In 2010 ARMZ's share in Akbastau was also transferred to Uranium One.

Zhalpak: owned by Ortalyk, with a design capacity of 750 tU. Operating on a trial production phase. In December 2020 it was reported that CGN had agreed with Kazatomprom to purchase 49% of shares in Ortalyk. Ortalyk also owns the Central Mynkuduk uranium deposit.

Central or Eastern mining group

The Central or Eastern mining group (Tsentralnoye) in the Chu-Sarysu basin comprises Tortkuduk, Moinkum, Southern Moinkum, Kanzhugan mines, plus the new refinery. Katco operates the first two, Taukent the latter two.

Moinkum (Muyunkum): Following three years' pilot plant operation, Areva and the state utility Kazatomprom agreed in April 2004 to set up a 1500 tU/yr in situ leach (ISL) uranium venture at Moinkum in this part of the Chu-Sarysu basin. Areva holds 51% and funded the US$ 90 million Katco joint venture, having spent some US$ 20 million already since 1996. Operation began in June 2006.

Tortkuduk (Moinkum North) is also part of the Katco JV and produced over 2400 tU in 2010. A South Tortkuduk project was mentioned by Areva in 2017, but may refer to Moinkum.

A June 2008 agreement expanded the Katco joint venture from mining 1500 tU/yr to 4000 tU/yr and sets up Areva to handle all sales from it through to 2039. At the end of 2016 Areva quoted Katco indicated resources as 24,162 tU @ 0.1%U, and inferred resources of 14,112 tU @ 0.08%U, with more pending ‘registration’. With production over 4000 tU/yr the Katco operation is the world’s largest ISL mine.

The Kanzhugan deposit supports the Kaynar mine which started up in 2008. South Moinkum is also operated by Taukent Mining & Chemical Co, a 100% subsidiary of Kazatomprom. Production from the two is over 1100 tU/yr.

Western mining group (#6)

The Western mining group (#6) is in the Syrdarya basin and comprises the North and South Karamurun mines operated by Mining Company #6, with Irkol and (North) Kharasan 1&2.

Kharasan: In 2005 UrAsia Energy Ltd (now Uranium One Inc) of Canada paid US$ 75 million for a 30% share of the Kyzylkum joint venture which owns the (North) Kharasan project. Kharasan 1 in mid-2013 had measured & indicated resources of 8561 tU, and proven and probable resources of 7132 tU. Inferred resources were 17,940 tU. Uranium One projected average cash cost of production for 2014 was $24/lb U3O8. In 2014 Kyzylkum lost the right to produce and the role was taken over by a new company, Khorosan-U with Energy Asia and Uranium One shares. From 2018 this has 50% Kazatomprom equity.

Kharasan 2 is to the south of this and was owned by Kazatomprom but is now controlled by the Baiken-U joint venture, including 95% Japanese equity. Pilot production commenced in 2009.

In April 2007 several Japanese companies – the Energy Asia consortium led by Marubeni – bought 40% of the Kharasan project to directly take 2000 tU/yr when it was in full production at 5000 tU/yr, planned to be about 2014. Project funding was $70 million from the Japan Bank for International Cooperation and $30 million from Citibank. Uranium One retains 30% equity of (north) Kharasan 1 through Kyzylkum JV.

A 2000 tU per year processing facility is matched with a 1000 tU/yr satellite plant. Pilot production commenced in April 2009 with Kharasan 1 to reach 3000 tU/yr by 2014, and Kharasan 2 to reach 2000 tU/yr in 2014. In fact production from both mines together reached only 2500 tU in 2015. Pre-commercial mining commenced in 2008 first significant production for both was early 2010. Production from the $430 million project will primarily supply Japanese utilities. In August 2009 Kazatomprom announced that a wrong technological decision in 2006 regarding development of the deposits had "led to a failure of the 2008-09 production program" and consequent lack of funds, but this was being rectified. Uranium One said that bore holes had been drilled incorrectly and that organic matter was increasing acid consumption.

Irkol started up in 2008, and ramped up for 750 tU/yr by 2010. In October 2008 China's CGN-URC took a 49% share of it through the Semizbai-U JV (see introductory section and below). China Nuclear Energy Industrial Corp (CNEIC) is also involved, possibly as customer for part of the Chinese share of production. The mine was formally opened in April 2009 with some fanfare, as the first mine to be put into commercial operation within the framework of the Kazakhstan-CGNPC nuclear power agreement. All the production is sold to CGN.

Karamurun: North Karamurun was expected to start up in 2007, South Karamurun in 2009.

Southern mining group

The Southern mining group in the same Syrdarya basin has the Zarechnoye mine.

Zarechnoye, discovered in 1977, started production early in 2009. Reserves were earlier quoted at 19,000 tU, but in mid-2013 measured & indicated resources are 7988 tU and proven and probable resources 4510 tU. Inferred resources are 4500 tU. The US$ 60 million Zarechnoye joint venture involved Kazatomprom (49.67%), ARMZ (49.67% – to provide finance) and Kyrgyzstan's Kara Baltinski Mining Combine (0.66%), which finally treats and calcines the product there, 400 km east. The mine produces over 930 tU/yr. In mid-2010 ARMZ agreed to transfer its share to Uranium One. Uranium One projected average cash cost of production for 2014 as $28/lb U3O8.

South Zarechnoye was discovered in 1989 and was being developed by the same joint venture to commence production in 2014, eventually at 620 tU/yr. However, the project was put on hold in 202 due to low uranium price and a reduced resource estimate. In November 2013 Uranium One reported that “mineral resources on this property are insufficient to support development”.

In June 2006 Tenex signed a US$ 1 billion uranium supply contract with Zarechnoye JV for up to 6000 tU per year from 2007 to 2022. Initially this will come from Zarechnoye mine, but Budenovskoye will also contribute.

Northern Kazakhstan province

Outside of these two basins, in the Northern Kazakhstan province, the Vostok underground mine continues in production, with Zvezdnoye. The Semyibai ISL mine was commissioned at the end of 2009 with a capacity of 500 tU/yr from a uranium-rare earths deposit, and the second stage 200 tU/yr came on line in 2011. In 2008 China's CGN-URC took a 49% share of it and in 2015 this equity passed to CGN Mining Co Ltd. It is managed, with Irkol, by Semizbai-U LLP, a joint venture. China Nuclear Energy Industrial Corp (CNEIC) is also involved, possibly as customer for part of the Chinese share of production.

Earlier, Itochu Corp of Japan has signed a uranium purchase agreement with KazAtomProm for some 3000 tonnes of uranium over 10 years to be marketed in Japan and the USA. KazAtomProm intends to use a US$60 million loan from Japan¹s Mizuho Corporate Bank to raise uranium production at the Central Mynkuduk deposit to 1000 tU/yr, of which Itochu Corp will receive 300t.

Kazkh Uranium Resources (old data) 6 Provinces

| province | resources: tonnes U | proportion of Kazakh |

| Chu-Sarysu | 60.5% | |

|---|---|---|

| Northern (Stepnoye) group | 750,000 | |

| Eastern (Tsentralnoye) group | 140,000 | |

| Syrdarya | 12.4% | |

| Western (#6) group | 180,000 | |

| Southern (Zarechnoye) group | 70,000 | |

| Northern | 256,000 | 16.5% |

| Ily | 96,000 | 6% |

| Prikaspyi/ Caspian | 24,000 | 1.8% |

| Balkhash | 6,000 | 0.4% |

The Chu-Sarysu and Syrdarya deposits are all suitable for ISL recovery, the Northern deposits are mostly in hard rock apart form some ISL at Semizbai, Ily mineralisation is in coal deposits, Caspian has phosphate deposits, and Balkhash has some hard rock volcanic mineralization but the major deposits were exhausted in the Soviet era. A 2014 estimate puts 77% as amenable for ISL.

All uranium is exported, and with the 2006 joint venture agreements, Russia is the main immediate customer, but China now receives more than half of production.

Health and environment

Kazatomprom said that its enterprises in 2014 continued to ensure ecological safety at its mines, and 23 of the company's affiliates and subsidiaries have ecological management standards certification. More than KZT 1.19 billon ($11 million) was spent in 2014 on measures to reduce the environmental impact of uranium mining, including efficiency improvements to dust and gas collecting installations and water purification units.

Occupational safety and security at uranium production sites is monitored and in 2014 the number of detected violations of occupational and industrial safety requirements dropped by 28% compared with 2013.

Fuel cycle: front end

The internationally-significant Ulba Metallurgical Plant (UMP) at Oskomen also known as Ust Kamenogorsk in the east of the country was commissioned in 1949. It has a variety of functions relevant to uranium. (It also produces beryllium, niobium and tanatalum.)

In June 2008 the formation of a new company – Ulba Conversion LLP – was announced, to build a 12,000 t/yr uranium hexafluoride conversion plant here, with Cameco providing the technology and holding 49% of the project. Ulba has produced HF since 1952, and the new conversion subsidiary would fit in with Russian JV enrichment arrangements. In May 2013 Cameco said that it expected construction of the plant with 6000 t/yr capacity to commence in 2018, with first production in 2020, subject to a feasibility study from 2014. This plant will produce UO3 for conversion to UF6 at Port Hope in Canada.

Kazatomprom has a JV with Russia's TVEL for uranium enrichment, (agreed with Tenex in 2006 and set up in 2008). Initially this envisaged adding to the enrichment plant at Angarsk in southern Siberia where Russia has its main conversion plant and a small enrichment plant now being expanded to 4.2 million SWU/yr. Kazatomprom and Tenex agreed to finance a 5 million SWU/yr increment to this. Each party would contribute about $1.6 billion and Kazatomprom would hold 50% equity. When this looked uneconomic due to surplus enrichment capacity, in March 2011 Russian equity in the JV was transferred from Tenex to TVEL and the Kazatomprom-TVEL JV Uranium Enrichment Centre (Closed Joint Stock Company UEC) was offered a share in the Urals Electrochemical Combine (Open Joint Stock Company UECC) which has a 10 million SWU/yr plant at Novouralsk instead. The Kazakh share in UEC would be 50%, related to the need to enrich 6000 tU/yr, and estimated to cost up to $500 million (though amount not disclosed). In the event the joint venture CJSC UEC took up a 25% share of UECC in September 2013 and became entitled to half its output – 5 million SWU/yr. In 2014 the UEC CJSC share was 4.99 million SWU, and in 2015 it was 5.11 million SWU. In March 2020 Kazatomprom sold its 50% interest in UEC to TVEL for RUR 6253 million (about $100 million), though it will continue to have access to UEC services at Novouralsk. This is distinct from the International Uranium Enrichment Centre (IUEC).

In September 2007 the joint stock company Angarsk International Uranium Enrichment Centre (IUEC) was registered with 10% Kazatomprom ownership and the balance Techsnabexport (Tenex). This share is being sold down to other partners – Ukraine confirmed 10% share in 2008, and Tenex is to hold only 51% eventually.

Since 1973 Ulba has produced nuclear fuel pellets from Russian-enriched uranium which are used in Russian and Ukrainian VVER and RBMK reactors. Some of this product incorporates gadolinium and erbium burnable poisons. Other exports are to the USA and Asia. Ulba briefly produced fuel for submarines (from 1968) and satellite reactors. Since 1985 it has been able to handle reprocessed uranium, and it has been making fuel pellets incorporating this for western reactors, supplied through TVEL. It is a major supplier to China.

A worker poses with a uranium fuel pellet at Ulba (Kazatomprom)

Ulba Metallurgical Plant (UMP) is majority owned by Kazatomprom and 34% by Russia's TVEL and has major new investment under way. It has secured both ISO 9001 and ISO 14001 accreditation. In 2007 a technological assistance agreement was signed with Japan apparently in line with government announcements that it would move towards selling its uranium as fabricated fuel or at least fuel pellets rather than just raw material. (One agreement is on fabrication of nuclear fuel components, between Kazatomprom, Kansai Electric and Sumitomo Corp.) In 2010, UO2 powder for Japan was certified by Japan's Nuclear Fuel Industries, and fuel pellets for China by CNNC's China Jianzhong Nuclear Fuel.

Kazatomprom has said that it aims to supply up to one third of the world fuel fabrication market by 2030, with China to be an early major customer. In June 2008 Areva signed a memorandum of understanding to provide engineering expertise to build a 1200 t/yr fuel fabrication plant as part of the Ulba complex, utilising fuel pellets from it. In October 2010 and November 2011 further agreements focused on a dedicated 400 t/yr line (51% owned by Kazatomprom, 49% Areva) specifically for fuel for French-designed reactors, including those in China. Another 800 t/yr line would be wholly owned by Kazatomprom. These plans with Areva appear to have stalled.

In December 2014 Kazatomprom signed an agreement with China General Nuclear Corp (CGN) focused on establishing the Ulba-FA joint venture to build a fuel fabrication plant for the production of 200 t/yr of fuel assemblies at the Ulba Metallurgical Plant. In December 2015 and September 2016 further agreements on this were signed, with UMP to have 51% and CGN-URC 49% shares in the $147 million project. In March 2016 Areva was awarded a contract for equipment and support to the Ulba-FA plant for the fabrication of AFA 3G fuel assemblies for CGN reactors. In December 2016 construction of the plant by Kazatomprom and CGN began. The plant opened in November 2021.

Kazatomprom was also negotiating technology transfer agreements to enable it to supply fabricated fuel for Westinghouse reactors, related to its 10% stake in Westinghouse.

International Atomic Energy Agency LEU Bank

The government in April 2015 approved a draft agreement with the International Atomic Energy Agency (IAEA) on establishing a low-enriched uranium (LEU) 'fuel bank' in Kazakhstan. The government nominated Kazakhstan to host an international LEU reserve on its territory under the auspices of the IAEA in 2010. According to international norms, such a 'fuel bank' must be located in a country with no nuclear weapons and be fully open to IAEA inspectors. The 'fuel bank' will be a potential supply of 90 tonnes LEU (as UF6) for the production of fuel assemblies for nuclear power plants. Any state wishing to develop nuclear energy will be able to apply to Kazakhstan for the uranium fuel needed for its nuclear power plants if other sources become problematical.

The Ulba Metallurgical Plant was proposed in 2012 as the site of this IAEA 'fuel bank', but in February 2013 it was reported that due to seismic considerations and local opposition it would not be sited there. However, negotiations with the IAEA concluded in February 2014 remained focused on the Ulba site at Ust-Kamenogorsk, aka Oskemen. (This is separate from Russia's similar concept under IAEA auspices.) In June 2015 the IAEA Board approved plans for the ‘IAEA LEU Bank storage facility’ to be located at the Ulba Metallurgical Plant (UMP) and operated by Kazakhstan, and a formal agreement with Kazakhstan to establish a legal framework was signed in August. A transit agreement with Russia for shipping LEU was also approved. An agreement between the IAEA and UMP was signed in May 2016 and the government ratified this in December. The facility was formally opened at the end of August 2017. In September 2018, the IAEA announced that the facility would be operational in 2019, and in November it awarded contracts to Orano and Kazatomprom to supply it. The first uranium was received in October 2019. The shipment through Russia comprised 32 cyclinders of LEU – sufficient for one reload of fuel for a typical light water reactor. The second shipment arrived in December 2019, completing the planned inventory.

'LEU IAEA’ is defined as LEU owned by the IAEA in the form of uranium hexafluoride (UF6) with a nominal enrichment of U-235 to 4.95%. ‘IAEA LEU Bank’ means a physical reserve of IAEA’s stored LEU of up to 60 full containers of the 30B type or later versions. Type 30B cylinders each hold 2.27 t UF6 (1.54 tU), hence about 92 tU. The IAEA bears the costs of the purchase and delivery (import-export) of LEU, the purchase of equipment and its operation, technical resources and other goods and services required for the functioning of the LEU ‘fuel bank’. Kazakhstan will meet the costs of LEU storage, including payment of electricity, heating, office space and staff costs. The document allows for the possible transfer of the LEU ‘fuel bank’ to another site from the Ulba Metallurgical Plant. The agreement has a ten-year duration with automatic renewal at the end of this period.

The IAEA LEU Bank is fully funded by voluntary contributions including $50 million from the US-based Nuclear Threat Initiative (NTI) organization, $49 million from the USA, up to $25 million from the European Union, $10 million each from Kuwait and the United Arab Emirates, and $5 million from Norway.

In 2015 the Russian government signed an agreement with the IAEA to allow transit of LEU to and from the LEU Bank, and in April 2017 the China Atomic Energy Authority signed a similar agreement with the IAEA.

Nuclear power: past

The BN-350 fast reactor at Aktau (formerly Shevchenko), on the shore of the Caspian Sea, was built under Russia's Minatom supervision. It was designed as 1000 MWt capacity but never operated at more than 750 MWt (potentially 350 MWe) and after 1993 it operated at only about 520 MWt when funds were available to buy fuel. It was operated by the Mangistau Power Generation Co. (MAEK), and was a prototype for the BN-600 reactor at Beloyarsk.

The plant successfully produced up to 135 MWe of electricity and 80,000 m3/day of potable water over some 27 years until it was closed down in mid 1999. About 60% of its power was used for heat and desalination and it established the feasibility and reliability of such cogeneration plants. (In fact, oil/gas boilers were used in conjunction with it, and total desalination capacity through ten multi-effect distillation (MED) units was 120,000 m3/day.)

The power complex structure at Aktau, including three gas-fired power plants, is operated by MAEK-Kazatomprom LLP, set up in 2003. It produces 500 MWe and 40,000 m3/day of potable water, using cogeneration distillation.

Nuclear power: future

Kazakh plans for future nuclear power include 300 MWe class units as well as smaller cogeneration units in regional cities. In 2012 the government had a draft master plan of power generation development in the country until 2030. According to this plan, a nuclear electricity share then should be about 4.5%, requiring about 900 MWe of nuclear capacity. Current generating capacity is about 20 GWe, and 2030 needs are projected as 150 TWh. Early in 2016 there were plans to build two nuclear power plants, one of which would be Russian.

Feasibility studies in 2013 were proceeding on the basis of using VBER-300. Possible sites included Aktau and Balkhash, as well as Kurchatov in East Kazakhstan. In January 2014 the President said: “The government should settle issues related to siting, investment sources and construction timeframe of the nuclear power plant” – and possibly more than one – by the end of March. In April 2014, Ulken on the western shore of Lake Balkhash was mentioned by the Ministry of Industry and New Technology as preferred, having both power needs and established grid. Kurchatov was the second possibility, with Aktau no longer favoured. A project management company was to be set up to finalize site selection and undertake a feasibility study.

In May 2014 nuclear generation was included in the Fuel and Energy Complex Development Plan to 2030, produced by the Ministry of Industry and New Technologies.

At the end of May 2014 NAC Kazatomprom signed an agreement with Rosatom to build a VVER nuclear plant, from 300 to 1200 MWe capacity, near Kurchatov. This would be at the Russian domestic price, not the world price, due to being part of “common economic space.” Rosatom said that the cost and configuration of the plant would depend on the feasibility study. Marubini Utility Service Ltd staff were reported to be active at Kurchatov. Rosatom announced that a draft intergovernmental agreement for construction of the plant at Kurchatov was signed at the end of September 2014.

As new atomic energy legislation was being negotiated in January 2015, the energy minister announced that a reactor, likely a Russian one, would be built at Kurchatov, and a second one would be at Balkhash if energy demand justified it. A Westinghouse AP1000 was being considered for Balkhash, subject to financial conditions and arrangements for construction, operation and servicing of the plant. Negotiations with Toshiba for supply of a Westinghouse AP1000 reactor had earlier been reported (Kazatomprom then being a 10% shareholder in Westinghouse).

Over 2007 to 2013 there were plans and negotiations regarding building a 600 MWe Japanese reactor at Ulken on Lake Balkhash – see Note a below for further information.

In April 2015 the Energy Ministry said that the site for a Russian reactor could be Kurchatov, or Ulken on the western shore of Lake Balkhash. In October 2015 the government said that a strategic partner for construction of the first plant would not be selected before 2017-18 on the basis that its power would not be needed before 2025. In November 2016 the Energy Minister said that plans to build a reactor has been postponed due to a lack of immediate need. In April 2019 the Kazakh press reported the Energy Minister confirming Ulken as the site for a Russian-built reactor should the government proceed.

In May 2019 Korea Hydro & Nuclear Power (KHNP) was reported to have lodged a bid with Kazakhstan Nuclear Power Plants (KNPP) to build two large reactors.

In December 2021 NuScale Power and KNPP signed a memorandum of understanding on exploring the possibility of deploying NuScale VOYGR plants in Kazakhstan.

In February 2022 the country’s Energy Director of the Department of Nuclear Energy and Industry said that the government was evaluating six suppliers: NuScale Power; US-Japanese consortium of GE Hitachi; KHNP; CNNC; Rosatom; and EDF. The country had planned to select a vendor towards the end of 2022/early 2023.

In June 2022 President Kassym-Jomart Tokayev said that the country had decided on the site for the construction of its first nuclear plant. He did not disclose the location, but it is likely to be at Ulken on the western shore of Lake Balkhash.

Earlier in 2016 an integrated nuclear infrastructure review (INIR) mission was carried out by the IAEA at the government’s request to report on Kazakhstan's legal and regulatory frameworks, nuclear safety and security, radioactive waste management, human resource development, stakeholder involvement and the capacity of the electrical grid.

In August 2023 the government announced Ulken Village in Zhambyl district of Almaty as the main option for the location of the country’s first nuclear power plant. There has been public concern over seismic activity in the region and subsequently the municipality planned to host a public hearing.

In September 2023, the president announced that the country was to hold a referendum to decide whether to build its first nuclear power plant. In January 2024, the government announced an action plan that includes a 5% nuclear share of the national generation mix by 2035. In October 2024 more than 70% of people who voted in the referendum backed new nuclear energy in the country.

Proposed nuclear power reactors

| Location | Type | MWe gross | Construction start | Operation |

| Ulken, L.Balkhash | VVER-1200 | 1200 |

|---|

Possible locations for Kazakh Nuclear Power Plant

In December 2016 the NNC was quoted as saying that five sites were under consideration: Ulken, on the western shore of Lake Balkhash in the south; Kurchatov, in the northeast close to the border with Russia; Kostanay, on the Tobol River in northern Kazakhstan; Taraz, on the Talas River in the south near the border with Kyrgyzstan; and Aktau, on the western shore of the Caspian sea. The Ulken and Kurchatov sites are preferred.

Russian prospect for small power reactor

The July 2006 Atomniye Stantsii JV with Atomstroyexport envisaged development and export marketing of innovative small and medium-sized reactors, starting with OKBM Afrikantov's VBER-300 PWR as baseline for Kazakh units. Russia's Atomstroyexport expected to build the initial pair and Kazatomprom announced that it planned to start construction in 2011 for commissioning of the first unit in 2016 and the second in 2017 at Aktau in the Mangistau oblast, on the Caspian Sea. The plant would then be marketed internationally.

However, the project then stalled over funding, and apparent Russian reluctance to transfer intellectual property rights on the VBER reactor. It was reactivated in 2009, with Aktau as the site, and this was confirmed in a feasibility study completed in 2010 which showed that for an electricity price of 8 tenge (US$0.05) per kWh, the plant would be paid off in 12 years. The project has passed environmental review. Kazakh officials had been seeking Russian guarantees on costs and technical issues for the first plant, and OKBM was looking for new partners to develop the design. The Atomic Energy Committee said it would call tenders for the first plant, to be built by 2020, but that the JV with Russia was the leading contender. An intergovernmental agreement in March 2011 appeared to progress this. Kazatomprom lists as a 50% subsidiary the JSC Kazakhstani Russian Company Nuclear Power Stations, dating from 2006, at Aktau.

In March 2013 Kazatomprom’s proposal to the government for a power plant at Aktau was accepted. Aktau has infrastructure and experienced personnel remaining from the BN-350 reactor which operated there 1973-99. However, early in 2014 the Mangistau provincial government opposed the choice of Aktau,and Kurchatov in the east then became the likely site. In January 2015 the energy minister confirmed this. Kazatomprom envisaged two VBER-300 reactors initially.

Kurchatov HTR, Japanese collaboration

In June 2008 an agreement on high-temperature gas-cooled reactor (HTR) research was initialled by the Japan Atomic Energy Agency (JAEA) and the Kazakhstan Atomic Energy Committee, focused on small cogeneration plants, in context of a broader 2007 agreement with NNC. In June 2012 and February 2013 further R&D agreements between National Nuclear Centre (NNC) and JAEA were signed relating to the design, construction and operation of the Kazakhstan HTR of about 50 MW at Kurchatov. Also in 2012 Kazakh Nuclear Technology Safety Centre (NTSC) signed an agreement with JAEA on safety research related to the HTR. All this comes under a May 2011 high-level intergovernmental agreement on developing nuclear energy.

The National Nuclear Centre (NNC) has proposed constructing 20 or more small reactors each of 50-100 MWe to supply dispersed towns, the first being at Kurchatov.

Radioactive waste management

The country has a major legacy of radioactive wastes from uranium mining, nuclear reactors, nuclear weapons testing, industrial activities, coal mining and oilfields.

A specific law covers radioactive waste management, and a new radioactive waste storage and disposal system is under consideration.

Decommissioning of the BN-350 fast reactor at Aktau (known as Shevchenko from 1964 to 1992) is under way, with extensive international support. Used fuel has been stored at site, as is 1000 tonnes of radioactive sodium.

In 1997, the USA and Kazakh governments agreed to undertake a joint program to improve safety and security for the plutonium-bearing spent fuel from the BN-350 reactor. By the end of 2001, all of this material had been inventoried, put under International Atomic Energy Agency (IAEA) safeguards, and placed in 2800 one-tonne 4 metre-long storage canisters, with more-radioactive and less-radioactive fuel packaged together, so that each canister would be self-protecting, making the fuel elements far more difficult to steal. This was necessary because much of the spent fuel had been cooling for so long, and was so lightly irradiated to begin with, that some of the individual fuel assemblies were no longer radioactive enough to be "self-protecting" against theft. The USA and Kazakhstan agreed to ship the material to the area of the former Semipalatinsk nuclear test site in northeast Kazakhstan, west and south of Kurchatov city for storage, and the US National Nuclear Security Administration (NNSA) designed and purchased dual-purpose transport and storage casks for that purpose. These were made at a former torpedo factory in Kazakhstan.

Some 3000 fuel assemblies – about 300 tonnes containing 3 tonnes of plutonium – were removed from the reactor site in 12 shipments over 2009-10 under US supervision, and were transported about 3000 km by train to a secure storage facility in Semlpalatinsk. This is licensed for 50 years, and the Kazakh government will be responsible for the ultimate disposition of the fuel beyond that. About 10 tonnes of fresh high-enriched uranium was sent to the Ulba plant at Ust-Kamenogorsk for downblending to low-enriched uranium.

The Semipalatinsk Test Site (STS) hosted about 470 nuclear weapons tests in the Soviet era and there remains a significant legacy of environmental damage there. The site was closed in 1991. The USA and Russia worked together over 1996 to 2012 with Kazakhstan to secure the former test site, which is bigger than the American state of New Jersey. The focus was on waste plutonium.

Research and development