Nuclear Energy and Sustainable Finance

- Increasingly, jurisdictions are taking policy and regulatory steps to enhance the role of the financial system in the transition towards low-carbon and sustainable economies.

- These regulatory actions focus on three broad themes: disclosure, risk management and the mobilization of capital. There is a move towards mandatory disclosure internationally.

- Over 20 countries have either implemented or are currently developing taxonomies. Some of the taxonomies issued to date specifically include nuclear energy while others currently exclude it. Many taxonomies under development intend to align with the EU taxonomy for sustainable activities.

- The ongoing evolution of environmental, social and governance (ESG) criteria presents both opportunities and risks to the nuclear industry.

- Multiple international initiatives are working to help mobilize capital for the sustainability transition by seeking to harmonize ESG standards and reduce market fragmentation. Some of these are likely to result in major changes to non-financial reporting and risk assessment by financial institutions.

Mounting concerns over environmental issues, and climate change in particular, have driven increasing consumer demand for environmentally-friendly products, while activists have strengthened public awareness of unsustainable practices and put pressure on companies to improve their performance on sustainability. In response, there has been a growing focus on environmental, social and governance (ESG) issues, with many companies electing to report their performance against key criteria in order to allay public concerns and meet the needs of investors seeking to make sustainable investments. 'Sustainable finance' refers to the process of taking ESG considerations into account when making investment decisions in the financial sector.

|

Box 1: ESG investing

The term 'ESG' (environmental, social and governance) has become synonymous with sustainable finance as a whole, but strictly speaking applies only to corporate reporting on certain key metrics. Investors may seek to make ethical, impact, or socially responsible investments. While also often conflated, these have specific definitions:

|

In recent years the amount of assets factoring in ESG principles has grown considerably, surpassing $35 trillion at the start of 2020 – over 50% higher than the 2016 figure of $22.8 trillion – and representing over one-third of the total $98.4 trillion global assets under management1. At the 26th UN Climate Change Conference of the Parties (COP26) held in late 2021 in Glasgow, UK, it was announced that a network of financial institutions has pledged over $130 trillion in assets towards reaching net-zero emissions by 20502.

Alongside this rapid growth in the market there has been an expansion in the number of frameworks and standards, which companies can choose to report against. These standards all have different focuses; however, different standards are often inconsistent with each other and this may be misleading investors, leading to a misallocation of capital. For example, the same company assessed against different standards may achieve a substantially different score, while some standards are sector-specific and so may not be suitable for certain companies. For example, some standards may award a high score to, say, digital companies that have few direct environmental impacts, but award lower scores to the extractive and energy companies that support the digital companies' operations, irrespective of whether they are best performers in their sector.

Multiple efforts are now under way that seek to harmonize ESG frameworks and standards. These are mostly being led by finance sector organizations, but governments have become interested in ESG too, seeing it as an important tool to assist with mobilizing capital for the transition to sustainable economies. They have also become concerned about the potential for ‘greenwashing’ and begun to set regulations to ensure that only genuinely sustainable activities are included in financial products marketed as 'green'.

The ESG market will continue to grow, as will the number of policies that seek to regulate this market and push companies to report on their sustainability performance. Sustainable finance policies are focused in three main areas: disclosure requirements; risk management; and the mobilization of capital. There is a push towards mandatory reporting, at least for climate-related financial risks in the near term.

For the nuclear industry, developments in ESG represent both an opportunity and a threat. The sector has often been omitted from these asset classes due to its controversial nature and misunderstandings about its actual environmental impact. However, nuclear energy has the potential to report well against ESG criteria, especially when these criteria are applied consistently across different technologies3.

ESG reporting

A number of organizations seek to influence how companies report their ESG data and to assist investors seeking to make sustainable and ethical investments. These include: framework developers, standard setters, assurers and ratings agencies, data providers, voting and engagement service providers, issuers, investor coalitions and broader coalitions, and financial regulators.

The framework developers mainly influence principle-based concepts for how an ESG report is structured but can also influence the ESG-related information a company publishes. Many principles relate to, or are based on, the UN Global Compact and Sustainable Development Goals.

Standard setters publish detailed guidelines that support companies in understanding what ESG-related information they should disclose, by topic. They influence a company’s decisions about which ESG metrics to report on, and methodologies used to measure those metrics. The most well-known standard setters include:

- Climate Disclosure Standards Board (CDSB). Consolidated into the IFRS Foundation on 31 January 2022.

- Global Reporting Initiative (GRI).

- International Financial Reporting Standards Foundation (IFRS Foundation), formerly the International Accounting Standards Committee (IASC) Foundation. It is the legal entity under which the International Accounting Standards Board (IASB) operates.

- International Organization for Standardization (ISO).

- International Sustainability Standards Board (ISSB), established in November 2021 by the IFRS Foundation to develop the IFRS Sustainability Disclosure Standards.

- Task Force on Climate-related Financial Disclosures (TCFD) – climate and greenhouse gas focus only – established by the Financial Stability Board (FSB) in December 2015.

- Value Reporting Foundation (VRF), formed in June 2021 through the merger of the Sustainability Accounting Standards Board (SASB) and the International Integrated Reporting Council (IIRC). Due to consolidate into the IFRS Foundation in August 2022.

- Workforce Disclosure Initiative (WDI), administered by UK-based ShareAction.

Rating agencies will rate companies' performance based on their ESG policies, systems and measures. They provide a third-party assessment, comparable to the way that a credit rating agency will score a company's credit worthiness. Many credit rating agencies are integrating ESG factors into their methodologies.

Assurance providers offer advice to companies on how to disclose their ESG data, as well as auditing services for ESG reporting.

Data providers aggregate the ESG information that is available on companies – often through public reports, private research and company requests – and make that information available, often via their own media outlets. Some data providers specialize in particular areas of ESG.

Voting and engagement service providers serve as an interface between institutional investors and the companies they have shares in, acting to ensure that investor views on ESG are represented at shareholder meetings.

Investor coalitions are groups of investors that focus on resolving common ESG challenges. Such coalitions frequently include think tanks and other organizations that have been influential in determining investor thinking on ESG issues. The largest such alliance is the Glasgow Financial Alliance for Net Zero (GFANZ), which represents financial institutions with $130 trillion in private capital to direct towards decarbonization by 2050.

Broader coalitions bring together a range of ESG-focused organizations that advocate for ESG and offer various services to help companies understand how to measure, improve or report important aspects of their ESG performance.

Issuers are the entities that raise or borrow money. These may include governments or corporations. Green bond issuers use the money raised to finance environmentally sustainable activities.

Financial regulators aim to protect investors, maintain fair, efficient and transparent markets, and reduce systemic risk. Sustainability issues in general, and climate-related issues in particular, can raise challenges to meeting these objectives.

Sustainable finance initiatives

There are numerous ongoing initiatives that aim to accelerate the mobilization of sustainable capital and to increase the international harmonization of ESG standards.

FSB roadmap and TCFD recommendations

The Financial Stability Board's Roadmap for Addressing Climate-Related Financial Risks issued in July 2021 outlines work to assess and address the financial risks of climate change and focuses on four main, interrelated areas: firm-level disclosures; data; vulnerabilities analysis; and regulatory and supervisory tools5.

The Task Force on Climate-related Financial Disclosures (TCFD), which was established by the FSB in 2015, published its final recommendations in June 20176. The report provides a framework for organizations to disclose climate-related financial risks through their existing reporting processes. The TCFD recommendations are being pushed as a harmonization measure by several international organizations, including NGFS, IOSCO and the G20. It seems that the priority is to harmonize climate reporting and secure financing for decarbonization, before expanding this approach to the other ESG issues. A number of financial regulators are working towards making TCFD reporting mandatory. In the UK, over 1300 of the largest UK-registered companies and financial institutions have been required to disclose climate-related financial data in line with the TCFD recommendations from April 20227.

NGFS

Members of the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) exchange experiences, share best practices, contribute to the development of environment and climate risk management in the financial sector, and mobilize mainstream finance to support the transition towards a sustainable economy.

The NGFS hosts five workstreams: microprudential supervision; macrofinancial; scaling up green finance; bridging the data gap; and research. Scaling up green finance is arguably the one most important to the nuclear sector and is structured around four main topics:

- Promoting the adoption of sustainable and responsible principles in central banks’ investment approaches.

- Understanding and fostering the market transparency of green finance.

- Providing a joint central banks’ view on the various challenges climate change raises for the conduct of monetary policy.

- Encouraging the adoption of climate-related financial disclosure by central banks.

The NGFS Climate Scenarios explore the impacts of climate change and climate policy with the aim of providing a common reference framework to the finance sector, with many organizations using the scenarios to assess their own individual risks8. The NGSF and FSB are working together on climate risk scenario analysis and reporting.

IOSCO disclosure standards

The International Organization of Securities Commissions (IOSCO) represents international financial and securities exchange regulators covering more than 95% of the world's securities markets. Its Task Force on Sustainable Finance is carrying out work in three areas: sustainability-related disclosures for issuers; sustainability-related practices, policies, procedures and disclosures for asset managers; and ESG ratings and data products providers.

In November 2021, the task force published a report on sustainability-related disclosures for issuers to address the need for consistent and comparable sustainability-related products9. The report covers: asset manager practices, policies, procedures and disclosure; product disclosure; supervision and enforcement; terminology; and financial and investor education. IOSCO said the report "recognizes a clear need to address the challenges associated with the lack of reliability and comparability of data at the corporate issuer level and the ESG data and ratings provided by third-party providers to enable the investment industry to properly evaluate sustainability-related risks and opportunities."

A separate report also published in November 2021 covered recommendations for ESG data and ratings providers10. The report suggested that these providers could consider publicly disclosing their data sources and using transparent and defined methodologies. It also recommended that regulators consider focusing greater attention on ESG ratings and data products, as well as on the activities of the providers of them.

International Sustainability Standards Board

During COP26 in Glasgow, UK in late 2021, the IFRS Foundation announced the formation of the International Sustainability Standards Board (ISSB) to develop the IFRS Sustainability Disclosure Standards, which would enable companies to provide comprehensive sustainability information for the global financial markets11. Both the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VRF) will consolidate into the ISSB by June 2022.

Prototype climate and general disclosure requirements for consideration by the ISSB were developed by the Technical Readiness Working Group (TRWG) – formed by the IFRS Foundation to undertake preparatory work for the ISSB – along with the CDSB, the International Accounting Standards Board (IASB), the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD), the VRF and the World Economic Forum, with support from IOSCO and its Technical Expert Group of securities regulators12. The prototype requirements combine key aspects of climate-related disclosure requirements and recommendations of these organizations to create a global baseline set of standards.

The ISSB aims to produce its final climate standards by the end of 2022.

G20 working group on sustainable finance

The G20 Sustainable Finance Working Group was initially launched in 2016 as the Green Finance Study Group to identify institutional and market barriers to green finance as well as options to enhance the mobilization of private capital for green investment. In April 2021 it was upgraded to a full working group and tasked to develop a climate-focused sustainable finance roadmap, which was published in October 202113. Future G20 recommendations are expected to be consistent with those produced by other organizations, such as the ISSB and NGFS.

Published alongside the roadmap, its 2021 Synthesis Report warned against "the proliferation of inconsistent approaches [that] could generate market fragmentation, increase transaction costs (such as duplicating verifications, creating data inconsistencies, and leaving room for interpretations), and result in a higher risk of green and SDGs-washing"14. The working group recommended: "To meet the huge demand for investment that supports climate and sustainability goals, and to ensure that the financial system is resilient to climate-related risks, greater efforts and further international coordination are needed to scale up sustainable finance."

The working group is prioritizing work in three areas: improving the comparability and interoperability of approaches to align investments to sustainability goals; overcoming information challenges by improving sustainability reporting and disclosure; and enhancing the role of international financial institutions in supporting the goals of the Paris Agreement and the 2030 Agenda for Sustainable Development.

International Platform on Sustainable Finance

Launched by the European Union in 2019, the International Platform on Sustainable Finance (IPSF) offers a multilateral forum for dialogue between policymakers in charge of developing sustainable finance regulatory measures. The objective of the IPSF is to scale up the mobilization of private capital towards environmentally sustainable investments.

The IPSF focuses on taxonomy development, as well as standards and labelling for sustainable finance products. One objective is to create greater international alignment with the EU approach to sustainable finance and ESG, and especially taxonomies.

In its first annual report, released in 2020, the IPSF notes: "Many IPSF jurisdictions are considering developing a taxonomy and the potential for comparability in this area is significant. The IPSF has initiated a working group on taxonomies that will work toward a “Common Ground Taxonomy” highlighting the commonalities between existing taxonomies. This Common Ground Taxonomy will enhance transparency about what is commonly green in member jurisdictions and contribute to scale up cross-border green investments significantly"15.

The IPSF's Common Ground Taxonomy report published in November 2021 provides an analysis on approaches used in the EU taxonomy and China taxonomy development16.

Alignment of corporate reporting

In 2020 five framework and standard setting institutions – the CDP (formerly the Carbon Disclosure Project), the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC), and the Sustainability Accounting Standards Board (SASB) – agreed to work together in order to address the confusion among producers and users of sustainability information resulting from the complexity of sustainability disclosure17. The intent of this work is to provide joint guidance on how their frameworks and standards can be applied in a consistent way, as well as complement financial generally accepted accounting principles.

The timeline and work programme for this initiative is unclear and may since have been overtaken by later events, such as the consolidation of the ISSB with the CDSB and VRF (see above section on the International Sustainability Standards Board).

Science Based Targets initiative

In October 2021, the Science Based Targets initiative (SBTi) – a partnership between CDP, the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF) – launched its net-zero corporate standard, which provides guidance, criteria, and recommendations for companies to set science-based net-zero (by 2050) targets, consistent with limiting the global temperature rise to 1.5°C above pre-industrial levels18.

The SBTi is also developing a global standard to enable the financial sector to achieve net-zero by 2050 and in November 2021 issued a draft consultation paper titled Foundations for Science-Based Net-Zero Target Setting in the Financial Sector19.

Development of sustainable finance regulation

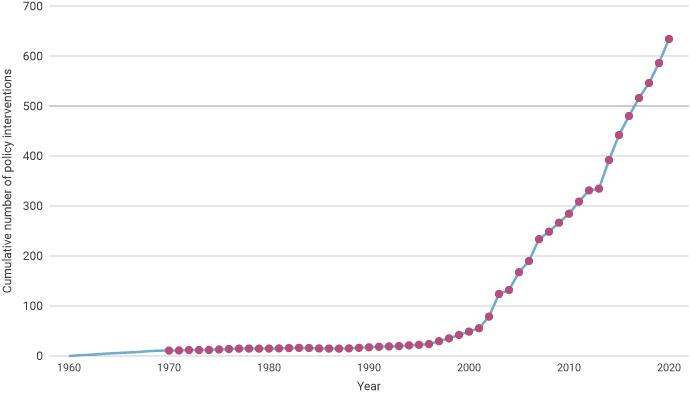

The current trend is towards increasing regulation of ESG and sustainable finance. Principles for Responsible Investment (PRI), which is supported by the United Nations, maintains a regulation database that shows the number of sustainable finance policy interventions growing rapidly since the beginning of the 21st century (see Figure 1). Increasingly, jurisdictions are taking policy and regulatory steps to enhance the role of the financial system in the transition towards sustainable development. These policy actions are focused on three broad areas:

- Disclosure: ensuring that sustainability disclosures made by financial and non-financial institutions help to identify exposures to climate, environmental and social risks.

- Risk management: requiring financial institutions to increasingly incorporate climate and sustainability factors into their risk assessment methodologies and decision-making processes.

- Mobilization of capital: mobilizing capital towards environmentally-friendly activities and technologies by providing incentives for green assets.

Figure 1: The number of responsible investment policy instruments has been growing (Source: UN Principles for Responsible Investment regulation database)

A March 2021 report from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) noted the following trends within the ESG sector4:

- Environmental and climate-related disclosure by financial and non-financial institutions is increasing rapidly, driven by both voluntary and mandatory standards and disclosure frameworks. (The Task Force on Climate-related Financial Disclosures (TCFD) framework especially is now widely recognized and implemented.)

- The demand for data means that some data providers are estimating and collecting ESG performance data, even for corporations that do not report their performance.

- Financial institutions are increasingly incorporating climate-related and sustainability factors into their decision-making processes as a prudential concern. (For example, about 40% of the members of the Basel Committee on Banking Supervision have issued principle-based supervisory guidance regarding climate-related financial risks.) The identification of climate and sustainability risks as sources of financial risk facilitates the pricing of assets.

- There are now many international institutions and coalitions which are advocating for and supporting the transition to low-carbon corporate business practices. Institutional investors, both unilaterally and through associations, are playing a key role in the mobilization of green capital.

The NGFS found that the following actions were needed to help catalyse the transition to a sustainable economy:

- Financial authorities to support: (i) global disclosure frameworks and efforts to establish a comprehensive corporate disclosure standard aligned with the TCFD recommendations; and (ii) the development of a global set of sustainability reporting standards such as being developed by the ISSB.

- Multinational financial institutions to adopt and promote global voluntary sustainability standards and disclosure frameworks.

- Credit as well as ESG rating providers to enhance transparency of their methodologies, disclosing the criteria they use to assess climate and sustainability factors, the manner in which these are measured and incorporated into ratings, and the weightings they assign to them.

- Regulators to require financial institutions to consider climate and sustainability factors as financial factors.

- National and multilateral development banks to strengthen their support to mobilize capital towards green investment projects, particularly in developing and emerging markets.

One particularly important trend is that many governments are now moving to make non-financial disclosure compulsory, alongside established annual financial reporting requirements. Compulsory disclosure potentially impacts not just access to capital but how assets and companies are valued. For example, the UK government intends to make climate disclosures mandatory for all large companies and financial institutions by 2025. In another example, the EU has already introduced regulation that will require companies over a certain size to declare the proportion of turnover derived from products or services associated with environmentally sustainable activities, and the proportion of economic capital and operational expenditure related to assets or processes associated with environmentally sustainable activities. This disclosure requirement has been linked to the EU taxonomy for sustainable activities (see below).

Regulations and policies are increasingly encouraging, and even compelling, companies to report their ESG performance – especially for companies based in, or seeking to do business in, the EU. What is unclear is the precise form regulation will take in each country and what requirements might result from some of the harmonization initiatives that are now under way.

National and regional taxonomies

The introduction of national (and regional) taxonomies is another trend with a growing number of countries considering these. These taxonomies seek to create official lists of economic activities categorized as sustainable either by government, regulators or in some cases a country’s banking sector. These are often created specifically for the purpose of allocating sovereign bonds or are restricted to a limited class of assets, but some (such as the EU taxonomy) are expected to apply to all types of investment.

Another important distinction between taxonomies is that while some will create a list of excluded economic activities (i.e. unsustainable activities), others will only list included activities and do not create separate categories either for excluded activities or those with no significant impact. Taxonomies do not aim to be comprehensive from the initial date of implementation, and further activities can be added to them later on. The intended scope of a taxonomy should be understood before reaching conclusions about how it potentially impacts any given industry that is not included in it. An economic activity can therefore either be included, excluded or omitted from a taxonomy. For nuclear energy it is also possible that the different fuel cycle activities may be split out and assessed independently under a taxonomy framework.

The following table provides an overview of how nuclear energy is treated in published taxonomies, or how available indications suggest it will be treated by taxonomies under development.

| Country/region, name | Status | Nuclear status |

|---|---|---|

| Association of Southeast Asian Nations (ASEAN), ASEAN Taxonomy for Sustainable Finance |

ASEAN Taxonomy Board established in March 2021. Taxonomy under development (Version 1 published November 2021). |

Unknown |

| Bangladesh, Sustainable FInance Policy for Banks and Financial Institutions |

Issued 2017, updated 2020. |

Excluded |

| Canada, Transition Finance Taxonomy | Work being led by the Canadian Standards Association (CSA) launched in February 2020. | Unknown |

| Issued 2015. Last updated 2021. | Included | |

| Chile, National Taxonomy for Chile | Under development – Taxonomy Roadmap for Chile published May 2021. | Unknown (mentioned in Taxonomy Roadmap for Chile) |

| European Union, EU taxonomy for sustainable activities | First delegated act adopted June 2021. Complementary Climate Delegated Act adopted March 2022. | Included in Complementary Climate Delegated Act |

| Georgia, Georgia Sustainable Finance Taxonomy | Under development. Roadmap for Sustainable Finance in Georgia published April 2019. | Unknown |

| India | Under development. | Unknown |

| Kazakhstan | Under development. | Unknown |

| Korea, K-taxonomy | Issued December 2021, nuclear added September 2022. | Included |

| Malaysia, Climate Change and Principle-based Taxonomy | Issued April 2021. | Not mentioned |

| Mongola , Mongolia Green Taxonomy | Issued 2019. | Not mentioned |

| Russia, Taxonomy for Green Projects | Draft guidelines issued September 2020; Taxonomy for Green Projects and the Russian Green Finance Guidelines approved September 2021. | Included |

| Singapore | Under development. Taxonomy consultation paper issued by the Green Finance Industry Taskforce in January 2021. | Mentioned in consultation paper |

| South Africa, Green Finance Taxonomy | Under development. Draft Green Finance Taxonomy published June 2021. | Not mentioned in draft |

| United Kingdom | Under development. Green Technical Advisory Group established June 2021. | Unknown |

In addition to the list above, since 2013, the Climate Bonds Initiative has published and regularly updated its own taxonomy, which includes nuclear energy. Also, ISO is developing a taxonomy for green bonds as part of its ISO 14030 Environmental performance evaluation – Green debt instruments series.

While taxonomies are important for the future development of ESG criteria as well as for the nuclear industry, not all jurisdictions are currently planning to introduce them. There seems to be a philosophical split between countries on whether governments should issue a ‘master list’ of sustainable economic activities, or whether to leave it to a bottom-up sector-led approach – i.e. by private investors and the ESG community determining which corporations and investments are sustainable.

EU taxonomy for sustainable activities

In December 2016 the European Commission (EC) established an expert group on sustainable finance to provide advice on how to steer the flow of public and private capital towards sustainable investments and to identify steps to protect the financial system from risks related to the environment. The recommendations of the group's final report published in January 2018 formed the basis of the EC's March 2018 Action Plan on Financing Sustainable Growth, which proposed several measures, including the establishment of a unified EU classification system – i.e. taxonomy – to define what is sustainable and identify areas where sustainable investment can make the biggest impact.

The Regulation on the Establishment of a Framework to Facilitate Sustainable Investment (the 'Taxonomy Regulation') was published in the Official Journal of the EU on 22 June 202020 and entered into force on 12 July 2020. Many key provisions of the Taxonomy Regulation are developed through delegated acts, the first of which – on sustainable activities for climate change adaptation and mitigation objectives – was published in April 2021 to enter into force from 1 January 2022. A second delegated act for the remaining objectives is due to be published by 2022.

Nuclear energy was originally kept out of the first delegated act was a result of the Technical Expert Group on Sustainable Finance (TEG) – which was set up in 2018 to advise the Commission on the technical screening criteria for the climate change mitigation and adaptation objectives – not providing a conclusive recommendation and requesting an expert assessment. In 2020 the EC launched an assessment and requested the Joint Research Centre to draft a technical report on the ‘do no significant harm’ aspects of nuclear energy21. This analysis, completed March 2021, “did not reveal any science-based evidence that nuclear energy does more harm to human health or to the environment than other electricity production technologies already included in the Taxonomy as activities supporting climate change mitigation."

The JRC report was reviewed by the Group of Experts on radiation protection and waste management under Article 31 of the Euratom Treaty22, as well as by the Scientific Committee on Health, Environmental and Emerging Risks (SCHEER)23. Both groups broadly confirmed the findings of the JRC in reports published in July, although SCHEER noted a few caveats.

Nuclear – along with gas – was included in the Complementary Climate Delegated Act, which was adopted on 9 March 2022 and will apply from 1 January 2023.

See EC webpage on the EU taxonomy for sustainable activities for further information.

ESG and the nuclear sector

For the nuclear sector, the expanding prominence of ESG presents both an opportunity and a threat. The opportunity lies in increasing investor/lender awareness of the comparatively strong performance of nuclear energy across a range of ESG indicators – and especially the key issue of climate change. With more and more countries announcing net-zero carbon dioxide pledges, nuclear energy would be able to help countries decarbonize electricity and hard-to-abate sectors such as heating and transport, while also increasing energy security. The main threat posed by ESG to the nuclear sector is in the form of taxonomies and future regulation, which if formulated poorly may drive investment away from the nuclear sector and affect both the long-term operation of existing plants and new plant construction.

Nuclear companies with ESG accreditation should be able to access financing from lenders at cheaper rates than they could expect to find otherwise. Financing costs often make up the largest single component of the levelized costs of a new nuclear plant, so reducing these costs would help to increase the viability of new nuclear projects. Small modular reactors especially are expected to be financed privately and not through intergovernmental arrangements. ESG accreditation could therefore be a key enabler for this emerging sector.

Nuclear energy not only has extremely low life-cycle carbon emissions, but it also performs extremely well across a range of environmental indicators. It is also the only large-scale energy-producing technology that takes full responsibility for all its waste, plans for its eventual disposal and fully costs this into the product. A November 2021 life-cycle assessment carried out for the United Nations Economic Commission for Europe by the Luxembourg institute of Technology demonstrates that nuclear is not only the lowest-carbon energy source available today, but that its material requirements and land use are exceptionally low24.

On the 'social' aspect of ESG, the nuclear industry is a well-paying responsible employer with a strong industry safety culture.

On the 'governance' aspect, the existence of independent regulators, strong nuclear institutions and various international safeguards and treaties places the sector amongst best performers.

Since many ESG frameworks and standards are aligned with the UN 2030 agenda, ESG accreditation would present an opportunity for nuclear companies to highlight their contribution to the SDGs. The nuclear sector contributes either directly or indirectly to all 17 of the SDGs, as highlighted in a March 2021 United Nations Economic Commission for Europe report25. Much of this relates to the bulk provision of clean electricity, but the many applications of radioisotopes also support the realization of the SDGs.

On the other hand, being listed as sustainable in a taxonomy doesn’t automatically mean that nuclear companies/assets will be included in green investment products, or that individual projects will find it easier to secure finance. Furthermore, where nuclear is left out or where it is specifically labelled as an unsustainable activity, this increases the likelihood that certain investors will be less likely to invest in nuclear projects.

Notes & references

References

1. Global Sustainable Investment Alliance, Global Sustainable Investment Review 2020 (July 2021) [Back]

2. Glasgow Financial Alliance for Net Zero, Amount of finance committed to achieving 1.5°C now at scale needed to deliver the transition (November 2021) [Back]

3. Generation IV International Forum, Nuclear Energy: An ESG Investable Asset Class (September 2021) [Back]

4. Network for Greening the Financial System, Sustainable Finance Market Dynamics: an overview (March 2021) [Back]

5. Financial Stability Board, FSB Roadmap for Addressing Climate-Related Financial Risks (July 2021) [Back]

6. Task Force on Climate-related Financial Disclosures, Recommendations of the Task Force on Climate-related Financial Disclosures, Final Report (June 2017) [Back]

7. Department for Business, Energy & Industrial Strategy, UK to enshrine mandatory climate disclosures for largest companies in law (29 October 2021) [Back]

8. Network for Greening the Financial System, NGFS Climate Scenarios for central banks and supervisors (June 2020) [Back]

9. International Organization of Securities Commissions, Recommendations on Sustainability-Related Practices, Policies and Disclosure in Asset Management, Final Report, FR08/21 (November 2021) [Back]

10. International Organization of Securities Commissions, Environmental, Social and Governance (ESG) Ratings and Data Products Provider, Final Report , FR09/21 (November 2021) [Back]

11. International Financial Reporting Standards Foundation, IFRS Foundation announces International Sustainability Standards Board, consolidation with CDSB and VRF, and publication of prototype disclosure requirements (November 2021) [Back]

12. Technical Readiness Working Group, IFRS Foundation, Climate-related Disclosures Prototype (November 2021) [Back]

13. G20 Sustainable Finance Roadmap (7 October 2021) [Back]

14. G20 Sustainable Finance Working Group, 2021 Synthesis Report (7 October 2021) [Back]

15. International Platform on Sustainable Finance, Annual Report (October 2020) [Back]

16. International Platform on Sustainable Finance, IPSF Taxonomy Working Group, Common Ground Taxonomy – Climate Change Mitigation, Instruction report (4 November 2021) [Back]

17. CDP, CDSB, GRI, IIRC and SASB, Statement of Intent to Work Together Towards Comprehensive Corporate Reporting (September 2020) [Back]

18. Science Based Targets initiative, SBTi Corporate Net-Zero Standard, Version 1.0 (28 October 2021) [Back]

19. Science Based Targets initiative, Foundations for Science-Based Net-Zero Target Setting in the Financial Sector: Draft for Public Comment, Version 0 (10 November 2021) [Back]

20. Official Journal of the European Union, Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 (June 2020) [Back]

21. European Commission Joint Research Centre, JRC Science for Policy Report: Technical assessment of nuclear energy with respect to the ‘do no significant harm’ criteria of Regulation (EU) 2020/852 (‘Taxonomy Regulation’) (29 March 2021) [Back]

22. Group of Experts referred to in Article 31 of the Euratom Treaty, Opinion of the Group of Experts referred to in Article 31 of the Euratom Treaty on the Joint Research Centre’s Report Technical assessment of nuclear energy with respect to the ‘do no significant harm’ criteria of Regulation (EU) 2020/852 (30 June 2021) [Back]

23. Scientific Committee on Health, Environmental and Emerging Risks, SCHEER review of the JRC report on Technical assessment of nuclear energy with respect to the ‘do no significant harm’ criteria of Regulation (EU) 2020/852 (29 June 2021) [Back]

24. United Nations Economic Commission for Europe, Life Cycle Assessment of Electricity Generation Options (October 2021) [Back]

25. United Nations Economic Commission for Europe, Application of the United Nations Framework Classification for Resources and the United Nations Resource Management System: Use of Nuclear Fuel Resources for Sustainable Development – Entry Pathways (March 2021) [Back]