Australia's Uranium Mines

Appendix to Australia's Uranium

There are three operating uranium mines in Australia: Ranger in Northern Territory, Olympic Dam in South Australia, and Beverley with Four Mile in South Australia. Four Mile has final processing through the Beverley plant. Honeymoon was shut down in 2013 pending improved uranium prices, and the main Beverley (and North Beverley) wellfields were also shut down soon after that. There are plans to bring Honeymoon back into production.

See also companion paper on Australia's Uranium Deposits and Prospective Mines.

Recent Production from Australian Uranium Mines

(tonnes of U3O8)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

| Olympic Dam | 3728 | 3813 | 2808 | 3736 | 3967 | 3611 |

| Ranger | 2005 | 2351 | 2294 | 1999 | 1751 | 1574 |

| Beverley | 0 | 100 | 20 | 0 | 0 | 0 |

| Four Mile | 935 | 1183 | 1815 | 1961 | 2080 | 2130 |

| Honeymoon | 0 | 0 | 0 | 0 | 0 | |

| Total | 6668 | 7447 | 6937 | 7696 | 7798 |

7315 |

Ranger

The Ranger mine and associated town of Jabiru is about 230 kilometres east of Darwin, surrounded by the Kakadu National Park, a major tourist attraction. This is a monsoonal part of Australia, with pronounced wet season from December to April. The first two orebodies are now mined out and work progressed to develop an underground mine, though in the longer term the Jabiluka orebody, 20 km away on a contiguous lease, is a more significant prospect (see Uranium Deposits information page). The mining authority ran to January 2021, 40 years from commencement. The traditional owners declined to extend it. Ore treatment ceased in January 2021 after production of 132,000 tonnes of uranium oxide concentrate.

History:

In 1969 the Ranger orebody was discovered by a Joint Venture of Peko Wallsend Operations Ltd (Peko) and The Electrolytic Zinc Company of Australia Limited (EZ). In 1974 an agreement set up a joint venture consisting of Peko, EZ and the Australian Atomic Energy Commission (AAEC).

In 1978, following a wide-ranging public inquiry (the Ranger Uranium Environmental Inquiry) and publication of its two reports (the Fox reports), agreement to mine was reached between the Commonwealth Government and the Northern Land Council, acting on behalf of the traditional Aboriginal land owners. The terms of the joint venture were then finalised and Ranger Uranium Mines Pty Ltd was appointed as manager of the project.

In August 1979 the Commonwealth Government announced its intention to sell its interest in the Ranger project. As a result of this, Energy Resources of Australia Ltd (ERA) was set up with 25% equity holding by overseas customers. In establishing the company in 1980 the AAEC interest was bought out for $125 million (plus project costs) and Peko and EZ became the major shareholders. Several customers held 25% of the equity in non-tradable shares. Ranger Uranium Mines Pty Ltd became a subsidiary of ERA. During 1987-8 EZ's interest in ERA was taken over by North Broken Hill Holdings Ltd and that company merged with Peko. Consequently ERA became a 68% subsidiary of North Limited, and this holding was taken over by Rio Tinto Ltd in 2000. This share increased to 86.33% in February 2020 to ensure that ERA had funds for rehabilitation.

In 1998 Cameco took over Uranerz, eventually giving it 6.69% of ERA, and Cogema took over other customer shares, giving it (subsequently Areva) 7.76%. Late in 2005 there was a rearrangement of ERA shares which meant that Cameco, Cogema and a holding company (JAURD) representing Japanese utilities lost their special unlisted status and their shares became tradable. The three companies then sold their shares, raising the level of public shareholding to 31.61%. This then reduced to 13.67% in February 2020.

Production and sales

The mine started operating in 1980. Full production was in October 1981 at a rate of about 3300 tonnes per year of uranium oxide concentrate. Ranger #1 open pit was mined out over 1980-94, then pit #3 over 1997-2012. The run of mine stockpile then comprised 1.4 Mt of ore at average 0.165% U3O8, which was treated by mid-2013. With other surface stockpiled ore averaging 0.12% U3O8 there is enough to last to 2020 if market conditions are favourable, or at least to 2016 when underground mining is planned to commence. However, annual production diminished from 2012 as progressively lower grade material is processed at a constant mill rate of about 2.4 Mt/yr. It is envisaged the lowest grade material might be blended with high-grade ore from underground from 2016. Uranium recovery ranges up to 93%.

Until 1990 all ERA sales of uranium concentrate were from Ranger production. Over several years the spot price of uranium concentrates was below the cost of production at Ranger, which made it advantageous over 1990-97 for ERA to purchase supplies from third parties. In 1994 the level of 1510 tonnes just exceeded that year's mine production. Further purchases were made 2001-05. The third party concentrates concerned mostly came from Kazakhstan. In 2011 ERA purchased 2126 t U3O8 to meet its sales commitments, including 1636 tonnes for actual 2011 sales. In 2012 about 500 t was purchased (387 t to end June). ERA sales are mostly under contracts with customers who are prepared to pay a price premium for long-term security of supply.

In 2013 production at Ranger was 2690 tonnes of U3O8 (2510 tU), curtailed due to closure of the treatment plant after a leach tank failed in December. (NB ERA reports drummed production, whereas Rio Tinto reports Ranger figures on a slightly different basis.) Operations resumed in June 2014, but no product was drummed in that half year, and only 1165 t U3O8 (988 tU) was produced in the full year. Mill head grade in 2014 was 0.11% with recovery 81.5%. In 2015, 2005 t U3O8 was produced.

All ERA uranium oxide sales are to energy utilities in Japan, South Korea, China, UK, France, Germany, Spain, Sweden and the United States under international and bilateral safeguards regulations. ERA supplied about 5% of the world's uranium production in 2012. Asia is a particularly important market, with most of the company's premium priced contracts there supplied from Ranger.

In 2008 total energy consumption was 1457 TJ, for production of uranium 2264 PJ (@ 500 TJ/t used in conventional reactor), ie 0.064% of output. CO2 equivalent greenhouse gas emissions were 155,0000 t.

Ranger treatment plant, with mine pit beyond

Process

Following crushing, the ore is ground and processed through a sulfuric acid leach to recover the uranium. The pregnant liquor is then separated from the barren tailings and in the solvent extraction plant the uranium is removed using kerosene with an amine as a solvent. The solvent is then stripped, using an ammonium sulphate solution and injected gaseous ammonia. Yellow ammonium diuranate is then precipitated from the loaded strip solution by raising the pH (increasing the alkalinity), and removed by centrifuge. In a furnace the diuranate is converted to uranium oxide product (U3O8).

Reserves & resources

The Ranger 1 orebody, which was mined out in December 1995, started off with 17 million tonnes of ore some of which is still stockpiled. The Ranger 3 nearby is slightly larger, and open pit mining of it took place over 1997 to 2012.

In 1991 ERA bought from Pancontinental Mining Ltd the richer Jabiluka orebody (briefly known as North Ranger), 20 km to the north of the processing plant and with a lease adjoining the Ranger lease. ERA was proposing initially to produce 1000 t/yr from Jabiluka concurrently with Ranger 3. The preferred option involved trucking the Jabiluka ore to the existing Ranger mill, rather than setting up a new plant, tailings and waste water system to treat it on site as envisaged in an original EIS approved in 1979. However, all these plans are now superseded – see information page on Australia's Uranium Deposits and Prospective Mines.

Ranger Ore Reserves and Resources, 31/12/19

| Grade U3O8 (%) |

Contained U3O8 (tonnes) |

|

|---|---|---|

| Total reserves in stockpiles | 0.071 | 1711 |

| Mineralised stockpile resources | 0.04 | 10,483 |

| Measured resources in situ (R3 Deeps) | 0.27 | 10,134 |

| Indicated resources in situ (R3 Deeps) | 0.22 | 22,636 |

| Inferred resources (R3 Deeps) | 0.20 | 8,579 |

| Total R3 Deeps resources | 0.224 | 43,858 |

| Total resources | 0.12 | 54,701 |

Note: figures are based on a 0.02% cut off for open pit resources, and 0.11% for underground resources (Ranger 3 Deeps). Resources are additional to reserves. A large reduction in resources in 2012 was due to reclassifying in-situ low-grade ores from Mineral Resources to Mineralised Inventory as pit 3 is backfilled, sterilizing the large pit shell resource.

In the Ranger 3 Pit and Deeps the upper mine sequence consists of quartz-chlorite schists and the lower mine sequence is similar but with variable carbonate (dolomite, magnesite and calcite). The primary ore minerals have a fairly uniform uranium mineralogy with around 60% coffinite, 35% uraninite and 5% brannerite. In weathered and lateritic ores the dominant uranium mineralogy is the secondary mineral saleeite with lesser sklodowskite.

In the second half of 2008 a $44 million processing plant was commissioned to treat 1.6 million tonnes of stockpiled lateritic ore with too high a clay content to be used without this pre-treatment. Following initial treatment the treated ore is fed into the main plant, contributing 400 t/yr U3O8 production for seven years. A new $19 million radiometric ore sorter was commissioned at the same time, to upgrade low-grade ore and bring it to sufficient head grade to go through the mill. It will add about 1100 tonnes U3O8 to production over the life of the mine, and be essential for beneficiating carbonate ore from the lower mines sequence of the Ranger 3 Deeps.

A feasibility study into a major heap leach operation for 10 Mt/yr of low-grade ore showed the prospect of recovering up to 20,000 t U3O8 in total. Column leach trials were encouraging, yielding extractions of greater than 70% at low rates of acid consumption. The facility would consist of fully lined heaps of material about 5m high and covering about 60-70 ha. These will be built and removed on a regular cycle and the residues stored appropriately after leaching is completed. The acid leach solutions would be treated in a process similar to that used in the existing Ranger plant and recycled after the uranium is removed from the pregnant liquor. ERA applied for government (including environmental) approval for the project, which was expected to begin operation in 2014, but in August 2011 ERA announced that the plan was shelved due to high capital costs and uncertain stakeholder support. As a result, ore reserves of 7,100 tonnes of uranium oxide were reclassified as resources.

In 2006 the projected operating life of the Ranger plant was extended to 2020 due to an improvement in the market price enabling treatment of lower grade ores, and in 2007 a decision to extend the operating Ranger 3 open pit at a cost of $57 million meant that mining there continued to 2012. However, reassessment of the low-grade stockpile in 2011 resulted in downgrading reserves by 6100 t U3O8. The #3 pit is now being backfilled, and to mid-2014, 31 million tonnes of waste material had been moved there. Following that it is being used for tailings, and all the material in the tailings dam will eventually be transferred there, using a dredge to recover it.

Ranger 3 Deeps

By November 2008 ERA had defined the Ranger 3 Deeps mineralisation target in the range of 15 to 20 million tonnes, and this has been confirmed as containing 33,000 tonnes of uranium oxide (28,000 tU) reported in the figures above. The mineralised zone has a strike length so far identified of about 1.2 kilometres between 250 and 550 metres from the surface, immediately east of the pit, and remains open to the north. Following regulatory approval in 2011, ERA awarded a A$50 million contract to McMahon Holdings for establishing a boxcut near pit 3 and 2.2 km decline in preparation for its own further drilling program. The decline reached a depth of 500 metres, and was built to handle eventual production. Work began in May 2012 and it was completed at the end of 2014, on schedule and on budget.

In June 2012 ERA approved spending A$57 million on a pre-feasibility study of the project to 2014, including 16,000 m of drilling. In January 2013 ERA applied for environmental approval of the Ranger 3 Deeps exploration decline project. In total the company planned to spend A$120 million on the project, plus a $57 million prefeasibilty study, leading towards a decision to mine early in 2015. About half the tailings from the underground ore will be returned there, and the mine footprint will shrink from 68 ha for pit 3 to 2 ha for the decline. In October 2014 the company lodged a draft EIS for the mine project, targeting first production at the end of 2015.

In June 2014 the company announced an update of resources in Ranger 3 Deeps after two-thirds of the drilling program was completed. A total of 32 km of drilling had been undertaken, and the decline reached 2221 metres from the surface. Total resources were 33,770 tonnes U3O8 averaging 0.274% grade at 0.15% cut-off, two-thirds in the upper mine sequence and one-third in the lower, which has higher carbonate levels. The pre-feasibility study (PFS) was considered by the Board early in 2015, and in June the company announced that it would defer proceeding further with development. This was due both to slow recovery in the uranium market and the requirement to cease operations under the Ranger Authority, which expired in January 2021. Majority owner Rio Tinto said it “does not support any further study or future development of Ranger 3 Deeps due to the project’s economic challenges.”

ERA had envisaged completing processing by Jan 2021 and completing $640 million site rehabilitation by 2026; these dates are not flexible, so prima facie would need to include all underground mining and treatment of any other ore (e.g. northern deposits on the Ranger lease).

In May 2016 ERA announced that a strategic review concluded that it would maximise cash flow from stockpiled ore reserves containing 10,383 t U3O8, and that it should preserve the option to develop the Ranger 3 Deeps project in the future by keeping the exploration decline and related infrastructure under care and maintenance at a cost of A$4 million per year. However, ERA stated: “Ranger 3 Deeps can only be viably developed with an extension to the current Ranger Authority which permits processing operations until January 2021. An amendment to the Atomic Energy Act of 1953 would be required to enable an application for an Authority extension.” Furthermore unless reactivation of Ranger 3 Deeps was before mid-2018, there would be a gap in production after exhaustion of stockpiled ore in 2020.

Occupational health & safety

Radiation doses received by employees are all well below recommended limits. The designated employees (most exposed to radiation) received an average dose of 1.3 millisieverts per year above natural background in 2008 compared with the recommended annual limit of 20 mSv averaged over five years. In first half of 2007 the maximum dose to any person was 3.9 mSv, hence less than 8 mSv/yr.

ERA’s occupational safety and health management systems are certified to AS4801. In 1994 ERA was the first Australian mine to be awarded a five-star rating by the National Safety Council, putting it in the top 5% of all industry occupational health and safety performance.

Infrastructure

Along with building other infrastructure used by the public, the company set up the town of Jabiru nearby. While it was initially envisaged that this would be solely a mining town, it has become an important regional centre for tourism and government services, including management of the National Park. Some 200,000 tourists visit the area each year.

Environmental management

ERA has been recognised for its world-class environmental management, achieving ISO 14001 certification in 2003.

Until 1996 tailings from the treatment plant were emplaced in an engineered dam on the lease. They were then deposited into the worked out #1 pit, and later to the tailings dam which was raised from RL 36 m to RL 60.5 m. No process or other contaminated water is released from the site, but concerns were raised about seepage from the tailings dam, and in 2009 the Supervising Scientist estimated this at 100 m3/day. Consequently the Gundjeihmi Aboriginal Corporation negotiated an independent hydrological review of the situation which resulted in many (79) more monitoring bores being established and a greatly improved seepage model. This will provide helpful data for the rehabilitation of the tailings area by 2026.

The Ranger mine is on a 7860 hectare lease which is surrounded by the World Heritage listed Kakadu National Park of 1.98 million hectares. About 500 hectares is actually disturbed by the mining and milling activities (0.025% of the total area).

Rainfall is monsoonal, with 700-2200 mm (average 1540 mm) falling in the wet season. The vegetation at Ranger is tropical open eucalypt forest, similar to much of the National Park.

The project area is leased from the Aboriginal traditional owners, title to the land being held by the Kakadu Land Trust. The Company contributes 4.25% of its gross sales revenue (the major part of its royalties of 5.5%) to NT aboriginal groups plus an annual rental of $200,000 for the use of the land. Ranger has paid a total of $345 million to aboriginal interests, including royalties, since the project began in 1980, in addition to jobs and community and social contributions. The royalty money is paid to the Commonwealth Government and then distributed to Northern Territory-based Aboriginal groups, including 30% to the Gundjeihmi Aboriginal Corporation (representing Traditional Owners), under the 1979 terms of the Commonwealth's Aboriginal Land Rights (NT) Act of 1976. Additional payments of over $7 million are on account of Jabiluka. The balance of royalty (1.25% of revenue) is paid to the NT government by the Commonwealth Government.

The company had a substantial environmental division, employing about 30 people and with an annual budget of nearly A $3 million. Part of this environmental effort was directed to land management issues of relevance not simply to Ranger, but to the surrounding National Park and World Heritage area. These include maintenance of biodiversity, fire management including control burning (which is very important and contentious in the region), terrestrial and aquatic weed control, feral animal control, mycorrhizal establishment, and rehabilitation of disturbed areas (including rock waste dumps, etc). Ranger is possibly the first mining operation deliberately to burn its own revegetated areas to assist the development of an appropriate vegetation community (Eucalypts and Grevilleas instead of Acacia dominance). Related issues being studied include artificial wetland filters, soil formation from waste rock, and hydrology.

Among Ranger's long term research priorities are projects which are relevant to eventual use of the land by its aboriginal owners.

ERA's success in environmental management gave rise to a consultancy, Earth Water Life Sciences, which gained significant business based on Ranger's environmental reputation.

Notwithstanding any results that may come from the ongoing exploration program, the company developed its plans for mine closure early in its history. A mine closure model has been prepared, and circulated to stakeholders, resulting in an estimate of the technical, environmental, social and other costs, through to final closure on both the Ranger project area and surrounds. This closure model is now the subject of review and refinement internally and with stakeholders. This model, which is progressively refined, has been used as the basis for calculating the financial provision required for eventual closure at the end of mine life. At the end of 2005 the net present value of the closure model for the Ranger project area and surrounds was estimated at A$186 million, fully provided for in the balance sheet. In mid-2011 the provision for rehabilitation and closure had grown to $550 million, with detailed studies continuing into 2012. In 2013 the estimate was $640 million. At the end of 2016, after substantial work had been commenced, the company had a rehabilitation provision of A$511 million plus provision for another A$100 million if required. In December 2018 the estimated cost was increased to $808 million, largely due to costs associated with tailings transfer to pit 3, with additional water treatment and related infrastructure and revegetation requirements, higher forecast costs relating to site services, and an increase in contingency.

In 2013 ERA was carrying out a $23 million prefeasibility study on an integrated tailings, water and closure strategy, work on which was ready to commence. Some 10 Mt waste rock backfill had been placed into pit 3 by mid-2013. Mill tailings were sent there from the start of 2015. From December 2015 the company has been dredging the tailings dam and sending 4.4 Mt/yr to pit 3. This will be followed by the remainder of low-grade ore after 2020. Waste rock will be used as capping. Much of the cost of rehabilitation is a $220 million brine concentrator to clean up tailings water for discharge, using heat. It produces a brine (95 ML/yr at pH 1.8 and total dissolved solids of 400,000 ppm) which is injected into the waste rock underfill at the bottom of pit 3, and 1300 ML/yr of clean water. It was commissioned in September 2013. In pit 1, filled with tailings, after a pre-load rock layer to compress the tailings and dewater them via 7700 dewatering wicks, initial coverage with laterite was completed in 2016 ready for waste rock covering to be followed by final landform shaping and revegetation over 39 ha.

An annually amended plan is submitted to government outlining the provision for rehabilitation following mine closure, which is reviewed by an independent auditor. Money for this purpose is partly in a trust fund administered by the Commonwealth government and partly covered by bank guarantee. The plan is updated annually in consultation with traditional owner representatives, regulators and key stakeholders.

Under the Ranger Authority, ERA had to cease mining and processing activities in the Ranger Project Area in January 2021, with final rehabilitation to be completed by January 2026. In October 2020 ERA released the updated Ranger Mine Closure Plan outlining the path to rehabilitation over about seven years.

See also ERA website.

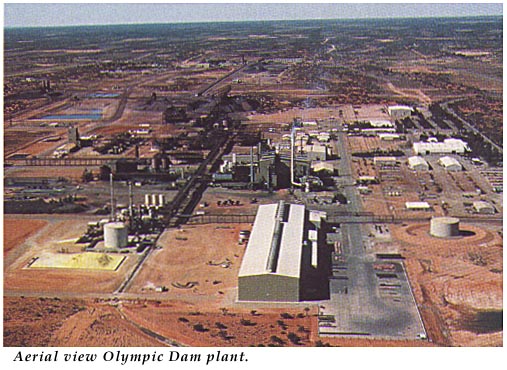

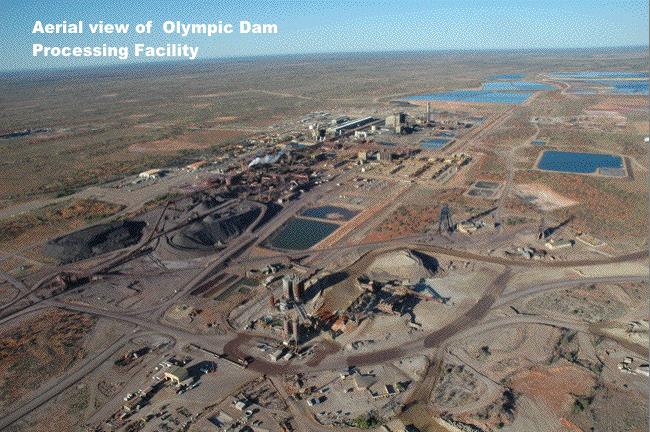

Olympic Dam

The Olympic Dam copper and uranium mine, with the town of Roxby Downs, is located 560 km north of Adelaide, near the opal mining centre of Andamooka. This is an arid part of Australia, receiving only an average of only 160 mm of rain per year, and that rather unreliably. The massive deposit is underground, some 350 metres below the surface, and besides its primary significance as a copper orebody, it is the largest known uranium orebody in the world.

History

The deposit was discovered in 1975 by Western Mining Corporation Ltd which was looking for copper in buried sedimentary rocks. After considering geophysical data a drill hole was sunk near a small stock water dam known as Olympic Dam. It struck copper, and later drilling confirmed a resource of more than 2000 million tonnes of ore containing both copper and uranium. From 1979 the deposit was evaluated as a Joint Venture with British Petroleum Ltd. In 1985 it was decided to proceed with the project, and production commenced in 1988.

WMC (Olympic Dam Corporation) Pty Ltd is the management company, a wholly-owned subsidiary of BHP Billiton Limited, which took over WMC Resources in mid-2005. Initially BP Minerals Ltd was a 49% partner in the enterprise, but WMC took over BP Minerals' share in 1993 for $315 million.

Over 1996-99 WMC undertook a A$ 1.25 billion program to more than double annual production to 200,000 tonnes copper and 3700 tonnes uranium concentrate (from 1500 tonnes). This expansion program was then accelerated, with the cost eventually rising to A$ 1.94 billion and the uranium capacity to 4600 tonnes U3O8 per year (which later declined to 4100 t/yr with decreasing grades).

OD expansion: WMC plans

Before the mid-2005 takeover by BHP Billiton, WMC Resources committed A$ 50 million over two years to assess the potential for doubling the size of Olympic Dam and in particular to take the resource categorisation of the southern orebody through to proven reserves and thus demonstrate the viability of a much expanded operation – up to 15,000 t/yr U3O8 (with 500,000 t/yr copper). The capital cost involved was estimated as at least A$5 billion. Some $4 billion had already been invested in the mine by WMC, including $680 million over 2001-04, and in 2004 the mine generated A$ 1100 million in export income. The WMC study included drilling on the southern deposit (later: Southern Mining Area) and assessing mining options including possibly a massive open pit (3 km wide, 1 km deep) to access the orebody. Up to June 2007 over 2000 km of drilling has been involved in defining the orebody.

OD expansion: BHP open pit and staged expansion plans 2005 to 2012

BHP Billiton then made a fresh appraisal of the possibilities on the basis that the previous assessment of market potential was too conservative. In October 2008, five stages of this expansion were defined, without a specific timeline. A pre-feasibility study to decide among the development options, and a 4600-page draft environmental impact study, were completed in 2009. The EIS (summary p20) stated: "Drilling of the ore body undertaken by BHP Billiton since 2005 has more than doubled the resource estimate from 3.98 billion tonnes of total mineral resource to 8.34 billion tonnes. At the same time, the expected demand and prices for the minerals means underground mining is no longer the preferred option for such a large ore body. Consequently, open pit mining has become the most feasible option for mining more of the resource. Underground mining can extract only about 25% of the ore containing recoverable quantities of copper, uranium, gold and silver, while an open pit would extract up to 98% as large zones of lower-grade mineralisation that were uneconomical for underground mining can be profitably bulk mined." In May 2009 the time span of progressive development was estimated as about 11 years from 2010.

The open pit would be developed over five years, removing overburden to expose the first part of the main orebody. Mining from it would then commence in mid-2016, and the pit would continue to be developed. The pit would eventually be 4.1 x 3.5 km, and 1000 m deep, and the waste rock storage about 67 km2 to a height of 150 m. Tailings storage would extend the existing facility to about 40 km2 and 65 m high to take 58 Mt/yr.

The main metallurgical plant (concentrator) would be developed in three successive 20 Mt/yr stages from 2012. A new hydrometallurgical plant to treat the tailings from this would be developed in conjunction. The existing electro-refinery and smelter would be upgraded to continue processing ore from either the existing (and continuing) underground operation or the open pit. However, two-thirds of the copper concentrate including some of the uranium would be exported to a dedicated smelter in China or Japan (see Appendix – OD expansion: BHP reduced smelting plans 2007 to 2014).

Required infrastructure would include: a 200 ML/day desalination plant (reverse osmosis) on Spencer Gulf, supplying the operation; much increased power provision by 650 MWe; a 105 km rail spur; a new airport; and accommodation expansion at and near Roxby Downs. Some of the power increment – about 250 MWe – could eventually be met by a cogeneration plant harnessing waste heat from burning sulfur at the acid plant. Most of it would need to come either from the grid or a 600 MWe combined cycle gas turbine plant at Olympic Dam.

A draft environmental impact study was released on 1 May 2009, and a Supplementary EIS was submitted to the government in December 2010. BHP Billiton moved the project to feasibility study stage in March 2011, and government approval was announced in October 2011.

However, in August 2012 BHP Billiton put the $28 billion project on hold while it investigated less-costly alternatives. In November 2012 the state government granted a four-year extension, conditional on the company spending $650 million on pre-project research on heap leaching and on community work.

OD expansion: BHP underground expansion and heap leach plans from 2014

In July 2014 BHP Billiton applied for government approval to build and operate a demonstration-scale heap leaching plant at Olympic Dam. Heap leaching has not previously been used for uranium ore in Australia (that at Rum Jungle over 1965-71 was for copper), though it is increasingly favoured for low-grade hard-rock uranium ores overseas. BHP-B uses it on a large scale at its Spence copper mine in Chile. Laboratory and pilot scale trials of the technique using run of mine ore from the existing operations have shown promising results to date. The company expected to start construction of the demonstration plant in the second half of 2015, with a three-year trial period starting in late 2016.

Some 36,000 tonnes of ore – about one day's current mine production – was used in the trial. The ore is crushed, placed on an impermeable leach pad and treated with sulfuric acid for 300 days. This is expected to recover most of the uranium, and with the help of bacteria, something like half of the copper. The uranium would then be removed from the pregnant liquor by solvent extraction, after which the copper would be removed electrolytically. This essentially reverses the present sequence where most of the uranium is recovered by acid leaching the mill tailings after copper sulfide flotation. Following the heap leaching, the depleted ore remaining will be further crushed, ground and put through a dedicated flotation plant onsite to recover the rest of the copper as sulfide, which would then be smelted as at present for all production. In September 2017 the company announced the first copper cathode from the trial.

In a general announcement about productivity in November 2014, BHP Billiton flagged a 27% increase in copper production at Olympic Dam from 2018 by streamlining haulage and treatment, and a doubling from that level subsequently by “a low-risk underground expansion with significantly lower capital intensity than the previous open cut design. This has the potential to deliver over 450,000 tonnes of copper production a year at first quartile C1 costs by the middle of next decade.” The uranium implications are not mentioned, but assuming the same head grades, it would mean 5000 t U3O8 from 2018 and some 10,000 t/yr in the mid-2020s. In September 2017 the company announced the first production from the Southern Mining Area, and that it had spent A$250 million in the 2017 financial year on expanding operations into that area.

In July 2016 the company confirmed that it would now focus on underground development only, and its increased copper production to 330,000 t/yr would involve a corresponding increase in uranium production. This was the Brownfields Expansion Plan (BFX). But in 2019 BHP reviewed the situation and downgraded plans to 240,000-300,000 t/yr of copper.

In mid-2020 the state government assessed BHP’s proposal to increase copper production from 200,000 t/yr to 350,000 t/yr in stages. In August the government approved plans for 300,000 t/yr copper, plus associated products, which would take the uranium oxide production potential to over 6000 t/yr.

In October 2020 the company said that over 400 km of underground drilling associated with the BFX project showed that copper resources in the southern mine were structurally complex and discontinuous. It therefore decided to abandon that project and focus on incremental process improvements to increase copper production beyond 200,000 t/yr. Production in the year to June 2020 was 172,000 t copper.

Production and sales

Olympic Dam is an underground mine. Some 12 million tonnes of ore is mined each year by open stoping.

In 2019 production was 3967 tonnes U3O8 (3364 tU) – about 6% of world mine total. Uranium recovery was earlier 65-70%, due to about half of the uranium being in the form of refractory brannerite, and this has been a focus for improvement, with 72.8% recovery being achieved in 2008, but only 68% in 2020.

Sulfur dioxide from the copper minerals is made into acid and used in uranium processing.

About 20% of Olympic Dam's revenue is from uranium, 75% from copper and 5% gold and silver.

Sales of uranium concentrate are made under long-term contracts to electric utilities in Canada, USA, Japan, South Korea, China, Finland, Sweden, Belgium, France and the United Kingdom.

Process

Following primary crushing underground, the ore is ground and treated in a copper sulphide flotation plant. About 80% of the uranium minerals remain in the tailings from the flotation cells, from which they are recovered by acid leaching. The copper concentrate is also processed through an acid leach to recover much of the other 20% of the uranium. The pregnant liquor is then separated from the barren tailings and in the solvent extraction plant the uranium is removed using kerosene with an amine as a solvent. The solvent is then stripped, using an ammonium sulphate solution and injected gaseous ammonia. Yellow ammonium diuranate is then precipitated from the loaded strip solution by raising the pH, and removed by centrifuge. In a furnace the diuranate is converted to uranium oxide product, U3O8.

Some uranium remains in the leached copper concentrate which goes to be smelted, and it is recovered in the smelting or electro refining stages.

Ore

The deposit occurs in the basement rocks of the Stuart Shelf geological province in the north of South Australia. Mineralisation consists of medium-grained chalcopyrite (CuFeS2), bornite (Cu5FeS4) and chalcocite (Cu2S), fine-grained disseminated pitchblende and brannerite (U minerals), gold, silver and rare earth minerals that occur in a magnetic hydrothermal breccia complex beneath 350m of overburden. The ore occurs in distinct zones that determine the mine access and layout. (mining-technology.com & infomine)

Reserves & resources

Olympic Dam has enormous reserves of ore, with 261,000 tonnes of contained uranium oxide. The overall resource contains some 2.1 million tonnes of uranium oxide in a hematite breccia complex. While the grade of the uranium ore is lower than many mines or potential mines which have the benefit of open cut operation, the fact that copper is a co-product with uranium from that same ore (at 1.88% Cu in the reserves) means that such grades are viable.

Olympic Dam Uranium Ore Reserves and Resources at 30/6/20

| Ore or resource (million tonnes) |

Grade U3O8 (%) |

Contained U3O8 (tonnes) calculated |

|

|---|---|---|---|

| Proved ore reserves: sulphide | 210 | 0.058 | 121,180 |

| Proved ore reserves: low-grade | 0 | - | 0 |

| Probable ore reserves: sulphide | 238 | 0.056 | 133,280 |

| Probable ore reserves: low-grade | 25 | 0.029 | 7250 |

| Total reserves | 448 + 25 | 0.05 & 0.029 | 254,460 + 7250 |

| Measured resources | 3300 | 0.021 | 693,000 |

| Indicated resources | 3440 | 0.020 | 688,000 |

| Inferred resources | 3330 | 0.020 | 699,300 |

| Total resources | 10,070 | 0.021 | 2.08 million |

NB. Resources inlcude reserves. Quoted metallurgical recovery from reserves is 68%.

Total resources measured as being solely accessed underground are 1041 Mt ore @ 0.047%.

The figures announcing a 27% increase in uranium resources, to 2.24 million tonnes of uranium oxide (1.9 MtU) in September 2007 were based on 2095 km of drilling over the previous two years and confirmed the deposit as the world's largest for uranium. It covers an area of over 6 km by 3.5 km, is up to 2 km deep and remains open laterally and at depth as the drilling program continues, further results being reflected in the above Table.

Occupational health & safety

The mine is well ventilated with powerful fans so that radiation exposure from radon daughters is very low. Exposure from gamma radiation is also minimal, due to the low grade of uranium mineralisation. The average annual radiation exposure level (over the 1.5 mSv/yr background) for all designated underground workers in 1999-2000 was 1.7 millisieverts (ranging up to 9.9 mSv). These levels compare very favourably with the annual limit of 20 mSv/yr averaged over five years.

The site has implemented a safety management system which is compliant to Level 3 exempt status under the state occupational safety organisation, and this has been officially recognised.

Infrastructure

Expansion of the mine would have brought major infrastructure challenges. The present 12 GL/yr water consumption (met from the Great Artesian Basin) would have grown, possibly to 70 GL/yr, requiring a coastal desalination plant with pipeline to Olympic Dam. The operation now uses 10% of the state's base-load power (870 GWh/yr) and the expansion would add demand for another 650 MWe and 4400 GWh/yr, the source of which had not been determined. The CO2 output from power generation attributable to the operation would be likely to grow from 0.9 to some 4.7 Mt/yr.

Environmental management

The mine lease of 18,000 hectares is managed by BHP Billiton Olympic Dam. The mine, smelter and infrastructure occupy about 7.5% of the lease area. Environmental management activities account for approximately one third of expenditure from the overall environmental budget, which is in excess of A$ 2 million. In February 2005, Olympic Dam was successful in obtaining ISO14001 certification for the site Environmental Management System.

The mine lease and the adjacent 11,000 hectare municipal lease have been destocked (of sheep and cattle) since 1986. Following the release of rabbit haemorrhagic disease (RHD), rabbit numbers in the region dropped significantly, and are currently at approximately 40 per square kilometre, compared with plague numbers of up to 600 /km2 in the late 1980s. Red Kangaroo numbers on the mine lease are about 20 per square kilometre, which is slightly higher than surrounding areas because of the access to water. In order to discourage wildlife from entering the tailings storage facility, alternative waterholes have been provided and deterrents installed on the dams and ponds. The evaporation ponds have been fenced with fine mesh to exclude small mammals and reptiles. Foxes and cats are controlled on the lease by shooting and trapping.

BHP Billiton Olympic Dam manages four pastoral stations in the area surrounding the mine and municipal leases with a total area of 1,136,000 hectares. These properties are conservatively stocked to maximise protection of sites of environmental or cultural significance.

The Arid Recovery project, which covers an area of 8,600 hectares, is situated largely on the mine lease and BHP Billiton-operated pastoral stations, with the remaining area (6 hectares) donated by local pastoralists. Arid Recovery is an ecosystem restoration initiative working to restore Australia's arid lands. The program is a partnership between BHP Billiton, the South Australian Department for Environment and Heritage, the University of Adelaide and the community group Friends of Arid Recovery. The reserve is surrounded by a unique cat, rabbit and fox-proof fence. Five locally extinct species have been reintroduced into the reserve.

Before clearing is undertaken for any development work or exploration on the mine and municipal leases, an Environmental/Indigenous Heritage Clearance Permit is required. During this process, all significant slow-growing trees and shrubs and areas of cultural significance are identified. Efforts are made to minimise disturbance caused by operational activity on the leases, and rehabilitation is undertaken afterwards where practical. Considerable attention has been given to rehabilitation of the hundreds of drill pads, some dating from initial exploration, so that many are now scarcely visible even on aerial photos.

Rock waste and the coarse fraction of tailings are used as mine backfill. Fine tailings material, still containing potentially valuable minerals (rare earths etc.) is emplaced in tailings dams on the lease covering about 400 hectares.

During 1994 seepage of contaminated water from the tailings dams was identified. This was of concern to the company, the regulators and the public because of the perceived threat to the quality of groundwater immediately below the tailings dams. Studies undertaken demonstrated that the pollutants in the seepage were quickly adsorbed on to clays and limestone in the soil and rock under the tailings dams, and, due to the low permeability and transmissivity of the rock, that there was no potential harm to the groundwater resource. The level of the groundwater under the tailings dams is monitored and modelled on a quarterly basis.

BHP Billiton Olympic Dam submits an Environmental Management and Monitoring report annually to the Department of Primary Industries and Resources South Australia (PIRSA) and the Environment Protection Authority (EPA). This comprehensive report covers all areas of potential environmental impact, including air emissions, site groundwater management, water supply and management of the Great Artesian Basin, flora and fauna monitoring and annual radiation dose to members of the public. Reporting on progress with action items identified in the Environmental Management Program is provided, as well as involvement with community activities.

Olympic Dam has a Rehabilitation and Closure Plan covering cost estimate basis, summary of closure requirements (for the metallurgical facilities, pilot plant, mine, tailings dams, wellfields, exploration areas, town facilities, power line corridor and miscellaneous facilities), community consultation requirements, closure strategy (including post operational land use objective and completion criteria) and closure plan review requirements. The plan provides a breakdown for each area to be decommissioned, including engineering works required (ie demolition and cleaning), environmental works (removal of contaminated material and rehabilitation), specific closure obligations for each area of plant, final land use objectives, closure assumptions, closure material sources, waste disposal sites, cost saving opportunities and liabilities/risks/hazards.

Demolition costs are budgeted based on quotations from a specialist demolition contractor and rehabilitation costs are estimated based on a quotation from a mining contractor with extensive rehabilitation experience. Progressive closure costs have been estimated for each year until actual closure of the site. The financial provision is calculated in line with BHP Accounting Standards.

Beverley and Four Mile

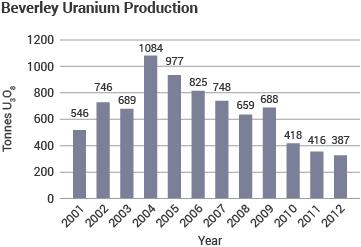

Over 2013-14 the scene changed here, with Beverley and then Beverley North suspending production, and except for 120 tonnes around the end of 2016, from January 2014 almost all production has been from Four Mile. Beverley is mined out. Heathgate now owns all the leases.

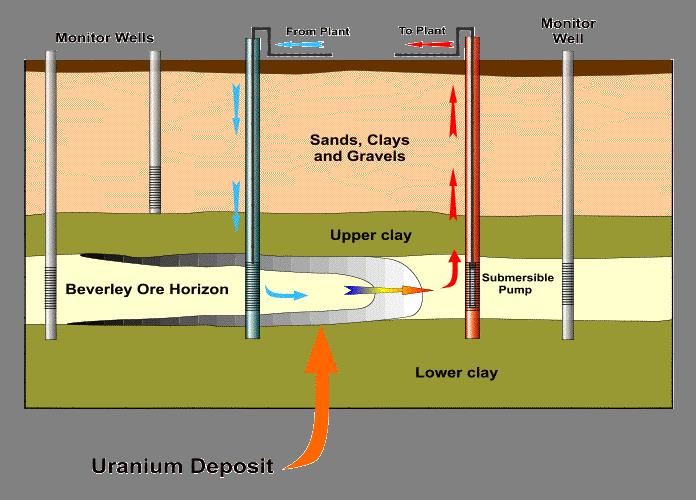

The Beverley uranium deposit is 520 kilometres north of Adelaide, on the plains northwest of Lake Frome and 25 kilometres northeast of the Arkaroola Resort in the northern Flinders Ranges. Beverley North is a contiguous lease. Beverley itself is a relatively young sandstone deposit in palaeochannels with uranium mineralisation leached from the Mount Painter region, and was the basis of Australia's first commercial in situ leach (ISL) operation. In 2008 a major mine lease extension was obtained to the north, and that the lease is now contiguous with the Four Mile lease to the north and west of it. However the mineralisation at Beverley North and Four Mile is in alluvial fan deposits which extend from the ranges out under the Beverley palaeochannels.

History and Background

Beverley was discovered in 1969 by the OTP Group (Oilmin NL, Transoil NL, & Petromin NL). A draft EIS was produced in 1982 but plans to mine it by in situ leaching (ISL) were abandoned in 1983 when a newly-elected South Australian Government made it clear that mining leases would not be approved. The deposit was sold to Heathgate Resources Pty Ltd, an affiliate of General Atomics of USA, in 1990.

The main Beverley deposit consists of three mineralised zones (north, central and south) in a buried palaeochannel (the Beverley aquifer) in tertiary sediments of the Frome basin. Groundwater salinity ranges from 3000 mg/L total dissolved solids in the north to 12,000 mg/L TDS in the south. The aquifer is isolated from other groundwater, notably the Great Artesian Basin about 150 metres below it and small aquifers in the Willawortina Formation above, which are used for stock watering.

A field leach trial in 1998 was successful, with performance three times better than similar deposits in USA, and it established the commercial viability of the project. A new draft EIS was released for public comment in July 1998 and the Supplement in October, with environmental approval being given in March 1999. Other approvals were in April 1999. Mine construction started in 1999, including processing plant, camp, airstrip, 4.0 MWe gas-fired power station and two wellfields.

As the main orebodies became depleted, in 2009 the Beverley North project was initiated and in 2010 a field leach trial at Pepegoona was successful. This became a satellite operation, with loaded resin being trucked to the treatment plant. In 2011 mining commenced at Pannikin, with a second satellite plant. These northern orebodies are closer to the Flinders Ranges and more complex geologically than the palaeochannel deposits. The satellite plants are on the lease boundary with the Four Mile leases. In December 2013 production from the Beverley wellfields was suspended, leaving only Beverley North operational for Heathgate, but this too was suspended from January 2014 to late 2016.

Four Mile comprises three alluvial fan deposits 5-10 km northwest of the Beverley mine and was explored by Quasar Resources Pty Ltd (a subsidiary of Heathgate Resources). The extended Beverley mine lease is contiguous. Alliance Resources Ltd through subsidiary Alliance Craton Exploration (ACE) was a 25% free carried joint venture partner. JORC-compliant resources are 54,000 t U3O8 at 0.31%. The East and West deposits remain open, with potential for further resource upgrade. They are about 3 km apart. Four Mile Northeast, close to Heathgate’s Pannikin satellite plant has an exploration target of 32,000-36,500 t U3O8 grading 0.27-0.30% U3O8 over 2.2 km strike length. Four Mile East is about 120 m deep and with good flow, Four Mile West is deeper and tighter.

Quasar applied for a mining lease in May 2008. An environmental assessment was published in January 2009. The mining lease was subject to registration of a Native Title Mining Agreement (NTMA), which was delayed, but a 10-year mining lease was granted to the partners in April 2012, and environmental approval in August 2013. Quasar commenced mining the East orebody in April 2014, using its nearby Pannikin satellite plant 2.5 km away, and then trucking the loaded resin to Heathgate’s main plant 10 km away for product recovery.

Quasar used its 75% interest to dictate development policy and timing for Four Mile. Alliance has contended that a separate treatment plant for Four Mile would be better economically than paying Heathgate to process the loaded resin. In May 2012 Alliance had entered an agreement with Itochu Corporation to take a 14.9% share in the company and then possibly 25.1% more. If both options were exercised the company would have been able to fund a stand-alone ISL operation at Four Mile, independently of Heathgate and the toll treatment at Beverley. Itochu taking up the equity was contingent upon restoration of Alliance’s full ownership of the deposit, which did not happen. In July 2014 Alliance solicited bids to buy its share of Four Mile, and in July 2015 this passed to Quasar for A$ 74 million.

For Beverley, Heathgate negotiated a royalty equivalent to 2% of gross sales with four Aboriginal Native Title Claimant groups, and the first payments totalling more than $100,000 were made to trust accounts in mid-2000. The agreements also provide for training, employment, community payments and administration payments.

Production and Sales:

Production from Beverley, licensed to reach 1180 t/yr U3O8 equivalent, commenced from the north mineralised zone in November 2000 though no product was drummed until 2001. Exports commenced in 2001. Production for 2004 reached 1084 tonnes U3O8 but then steadily dropped to around 400 tonnes from 2010 and in 2013, the last full year of operation involving the main orebodies, 98% of production was from Pepegoona and Pannikin on the Beverley North lease until production ceased there in January 2014. These Beverley North orebodies are adjacent to Four Mile. Sales contracts are with power utilities in the USA. The last production from Beverely was in 2014, until 100 t was produced in the second half of 2016.

From Four Mile, Quasar expected to spend A$ 77 million, excluding any development of the West orebody. Cash operating costs (A$28) plus development costs to end of 2014 work out to about A$ 40/lb U3O8, with sale price expected to be A$ 49/lb. The production rate in mid-2014 was 1200 t/yr U3O8, which is about the capacity of the Beverley mill. In 2014, 755 t U3O8 was produced, rising to 935 tonnes in 2015. The first two shipments of product (total 213 t U3O8) were in September and October 2014, to Cameco Blind River, and the balance was stockpiled.

For the 13 months from December 2014 through 2015 Quasar anticipated production of 1200 t U3O8 from Four Mile, which would all be stockpiled. Expenditure of $108 million was planned, including capital. Cash operating costs are budgeted at $32/lb plus development costs of $9, total $41/lb U3O8.

Due to Quasar’s refusal to sell product, thereby depriving Alliance of funds, ACE refused to contribute to the 2015 program and budget. This meant that ACE’s share of the project would reduce from 25% to about 15% by the end of 2015. In November 2014 ACE terminated Quasar's appointment as sales and marketing agent of ACE's share of Four Mile product and instituted proceedings in the Supreme Court of South Australia seeking a declaration that the termination is valid and to order that ACE's share of product be delivered up to ACE. In May 2015 Alliance received a permit to possess uranium concentrate. It applied for permits to transport and export.

In February 2015 Alliance received an offer from Quasar to purchase all of ACE’s interest in the Four Mile Project, including ACE’s share of uranium oxide concentrates already mined (worth over $20 million), for AUD $57.6 million. This was raised to $74 million in July 2015, which Alliance accepted.

Resources

At Beverley, several ore lenses in unconsolidated sands lie at a depth of 100-130 metres, over some 4 km of palaeochannel. The three initially mined contained at least 21,000 tonnes of uranium oxide at 0.18% grade, mostly recoverable by in situ leaching. In November 2006 the company applied to extend the mine lease to take in contiguous ground at Beverley North including Pepegoona (with 4000 t U3O8) and Pannikin. The cumulative total recovered from Beverley and Beverley North to shut-down in January 2014 was 8614 tonnes U3O8.

The Four Mile West deposit has 14,000 t indicated resources and 4700 t inferred resources, at 0.34%. Alliance in June 2009 confirmed 13,000 tonnes U3O8 at 0.31% inferred resources for the East deposit, making a total of 32,000 t U3O8 at 0.33% (27,100 tU at 0.28%U). A cut-off of 0.5 metres at 0.10 m% grade thickness (GT) was used for both resource estimates, assuming ISL mining.* Both deposits remain open, with potential for further resource upgrade. They are about 3 km apart. There are three mineralised layers between 190 and 210 metres deep, ranging from 1.1 to 7.3 metres thick and with grades up to 1.74% U3O8.

* ISL resources are reported in terms of grade thickness (GT) – average grade U3O8 multiplied by thickness of leachable sand holding the uranium.

Some additional mineralization has been identified in the western area of Four Mile West, which has the potential to add up to 30% to that resource if this mineralization is proved recoverable by ISL, or mineable by other means.

For Four Mile Northeast, some 1200 metres northeast of the East orebody and close to Heathgate’s Pannikin satellite plant, Alliance had an exploration target of 32,000-36,500 t U3O8 grading 0.27-0.30% U3O8 over 2.2 km strike length, with a JORC-compliant inferred resource figure of 22,686 t U3O8. The exploration target figure is for an area stretching from Four Mile East past Pannikin almost to Pepegoona, though the mineralisation is interpreted to lie within an apparent regional roll-front type redox interface that embraces the Four Mile West, Four Mile East, Pannikin and Pepegoona deposits over a total strike length of 7.5 km.

Mineral resources at Four Mile, 30/6/15

| Grade % U3O8 | tonnes U3O8 | JORC class | |

| Four Mile West | 0.34 | 14,520 | indicated |

| 0.31 | 4,080 | inferred | |

| Four Mile East | 0.31 | 13,160 | inferred |

| Four Mile Northeast | 0.30 | 22,686 | inferred |

Grade thickness cut-off is 0.10%. Source: Alliance

Process

The mines consist of wellfields which are progressively established over the orebody as uranium is depleted from sections of the orebody immediately underneath. Wellfield design is on a grid with alternating extraction and injection wells, each of identical design and typical of normal water bores. The spacing between injection wells is about 30 metres with each pattern of four having a central extraction well. A series of monitor wells are situated around each mineralised zone to detect any movement of mining fluids outside the mining area.

Beverley wellfield

Submersible electric pumps initially extract native groundwater from the host aquifer prior to the addition of uranium complexing reagents (acid) and an oxidant (hydrogen peroxide or oxygen) before injection into the wellfield. The wells are cased to ensure that liquors only flow to and from the ore zone and do not affect any overlying aquifers. They are pressure tested before use. The leach liquors pass through the ore to oxidise and dissolve the uranium minerals in situ. The pregnant solution from the production wells is pumped to the treatment plant or satellite plant where the uranium is recovered in a resin ion exchange (IX) system. If at a satellite plant, the loaded resin is trucked to the central treatment plant.

The uranium is then stripped from the ion exchange resin, and precipitated with hydrogen peroxide. The uranium slurry is dewatered and dried to give hydrated uranium peroxide (UO4.2H2O) product. From 2010 it was expected that the plant would also treat loaded resin trucked in from the Four Mile project adjacent to the Beverley North satellite operations. In fact, from 2011 it treated resin trucked from Pepegoona and Pannikin, further north than this, and 70m from the Four Mile lease boundary. In April 2014 it commenced recovery of uranium from the Four Mile JV, with the resin loaded at the Pannikin satellite plant.

Before the remaining process solution is reinjected, it is oxygenated and if necessary recharged with sulfuric acid to maintain a pH of about 2.0 to 3.0. Most of the solution is returned to the injection wells, but a very small flow (about 0.5%) is bled off to maintain a pressure gradient in the wellfield and this, with some solutions from surface processing, is treated as waste. It contains various dissolved minerals such as radium, arsenic and iron from the orebody and is reinjected into approved disposal wells in a depleted portion of the orebody. This bleed of process solution ensures that there is a steady flow into the wellfield from the surrounding aquifer, and serves to restrict the flow of mining solutions away from the mining area.

Occupational Health and Safety

The usual radiation protection measures are applied, despite the fact that most of the orebody¹s radioactivity remains well underground and there is hence minimal increase in radon release and no ore dust. Designated employees wear personal dosimeters to measure exposure to gamma radiation and radon daughter concentration is measured regularly in the plant area. Routine monitoring of air, dust and surface contamination is also undertaken.

Environmental Management:

An Environmental Management and Monitoring Plan (EMMP) has been developed with the regulating authorities, who determined the requirements of it, including those for radiation protection. The Plan provides for ongoing management of every aspect of the operation. Monitoring to detect possible horizontal excursions from the mining zone or any vertical leakage into other aquifers is a fundamental facet of mine operations.

In contrast to the main ISL operations in USA extracting uranium from aquifers with potable water, the groundwater quality at Beverley is very low, being fairly saline and orders of magnitude too high in radionuclides for any permitted use to start with. Fluids from mined areas are progressively moved to new mining areas, thus reducing the overall effect on the aquifer. After completion of mining, when oxygen input and leaching are discontinued, the groundwater reverts to about pH 4.5, and then over time to its original condition at about pH 7.

Heathgate bought the 2350 sq km Wooltana pastoral lease, from which the 13.5 sq km project area is fenced off and destocked. This area, mainly Mitchell grass plain, will be allowed to rehabilitate naturally to guide later revegetation of mined areas.

Upon decommissioning a wellfield, wells are sealed and capped, pipes are removed and the surface revegetated progressively. At the end of the mine's life, process facilities will be removed and after discussion with the stakeholders the land can revert to its previous uses. Heathgate has provided financial guarantees to the state government in respect to ongoing mine site rehabilitation up to the final completion of mining.

Honeymoon

The Honeymoon mine is about 80 kilometres northwest of Broken Hill, 30 kilometres inside South Australia. It was commissioned in 2011 with 340 t/yr U3O8 capacity. It was then closed at the end of 2013 due to technical issues coupled with low uranium prices, and in 2015 Boss Resources Ltd, now Boss Energy Ltd, took it over.

The central Honeymoon - East Kalkaroo deposit occurs in porous sand of the Yarramba palaeochannel at a depth of 70-130 metres and extending over about 150 hectares, with about 30 ha being the focus of attention in 2019. The orebody extends over about 6 km in total and comprises tabular rather than rollfront ore lenses, mainly coffinite.

In February 2019 Boss reported measured resources of 3450 tonnes U3O8 at 0.11%, indicated resources of 8630 tonnes U3O8 at 0.06% and inferred resources of 4130 tonnes for the restart area including Honeymoon itself, Brooks Dam and East Kalkaroo. In addition it reported figures for Jason’s and for Gould’s Dam, further away (tabulated below). This brought global JORC-compliant figures for Honeymoon plus Gould’s Dam to 32,500 tonnes U3O8.

Honeymoon and Gould’s Dam resources: February 2019, confirmed February 2021

| Resources | ppm U3O8 | Tonnes U3O8 | |

| Honeymoon & contiguous: restart area | measured | 1100 | 3400 |

| indicated | 610 | 8700 | |

| inferred | 590 | 4100 | |

| Gould's Dam | indicated | 650 | 2900 |

| inferred | 480 | 8500 | |

| Jason's | inferred | 790 | 4900 |

| West and East tenements, total project | 620 | 32,500 |

History

Plans were developed in the late 1970s to extract the uranium oxide by in situ leaching (ISL), and some $12 million was spent in preparation. Draft and Final Environmental Impact Statements were produced, and both South Australian and Commonwealth environmental approval was subsequently obtained in 1981 for production to 450 t/yr U3O8. Field tests of the ISL process were carried out and a $3.5 million, 110 t/yr pilot plant was built, but the project was abandoned in 1983. The aquifer has 8-10 g/L of chlorides, higher than other ISL projects, and at the time therefore requiring solvent extraction rather than ion exchange (better resins are now available). Mineralisation includes a significant proportion as phosphates, as well as uraninite and coffinite.

The Honeymoon deposit itself was discovered in 1972. MIM Holdings Ltd bought out CSR Ltd's 34.3% share in 1988. In 1997 Sedimentary Holdings NL reached agreement with MIM to acquire the Honeymoon leases next to its own East Kalkaroo deposit on the Yarramba palaeochannel. The 1997 agreement also included acquisition of the Gould Dam-Billaroo West leases 75 km northwest of Honeymoon. The 1997 agreement initially brought together known uranium resources of about 4200 tonnes U3O8 averaging 0.11% and amenable to in-situ leaching. The purchase was funded by Southern Cross Resources of Toronto. Sedimentary Holdings progressively reduced its share in Southern Cross through to 2004.

Aerial view of plant and infrastructure (wellfield is beyond at top left)

Trial wellfield (extraction well is left of centre)

Well header building

Inside well header building

Pilot plant

Field leach trials using the refurbished process plant resumed in 1998 and led to a proposal to produce about 1000 t/yr U3O8 equivalent (as uranium peroxide) at low cost. A June 2000 draft EIS covered the Honeymoon - East Kalkaroo deposits and this was approved in November 2001.

Further drilling and logging with a prompt fission neutron (PFN) tool in 2004 confirmed high-grade resources which were reported in terms of grade thickness (GT) – average grade U3O8 multiplied by thickness of leachable sand holding the uranium. In the Honeymoon deposit itself 3300 t U3O8 at an average GT of 0.84 m% was confirmed, with 900 t U3O8 at an average GT of 0.38 m% in East Kalkaroo adjacent. The program failed to extend these resources, and further drilling and logging of nearby parts of the Yarramba palaeochannel immediately NW of Honeymoon in 2004 failed to confirm further resources.

In 2004 the company revised development plans down to a 400 tpa plant at Honeymoon, but development was deferred pending the outcome of further exploration at Gould's Dam. In December 2005 Southern Cross Resources was taken over by Aflease to form sxr Uranium One Inc. (The 'sxr' was later dropped.) Following a new feasibility study, in August 2006 Uranium One announced that development of Honeymoon would proceed as a 400 t/yr ISL mine. In January 2007 a ten-year export permit was granted.

In October 2008 Uranium One announced a joint venture with Mitsui (49%) to complete development of the project, with Mitsui paying $104 million towards the eventual $138 million cost. Similar joint ventures with Mitsui would apply to Gould Dam and Billeroo.

In December 2008 Uranium One announced an engineering, procurement, and construction management contract with Ausenco Ltd to build the mine. Total capital cost envisaged was A$ 118 million, including pulsed column solvent extraction (SX) circuit. A mine life of six years (including ramp-up) was expected. In 2011 capital expenditure of about $20 million comprised $10 million for wellfield development and $10 million for other construction activities and fixed asset purchases. Four wellfields were established. Mitsui's A$ 104 million largely funded the commissioning. Capital expenditure took the total investment in the mine to $170 million.

In May 2012 Mitsui announced that it was withdrawing from the project. The parties negotiated the terms of this, and Uranium One "recognised a gain of $17.2 million as a result of the transaction." A February 2012 report quoted reserves of 2890 tonnes U3O8 at 0.08% and indicated resources of 5400 tonnes U3O8 at 0.129%.

From 2009, 51.4% of Uranium One Inc was owned by Russia's ARMZ, but in 2012 ARMZ moved to buy out all the other shareholders. It then had full ownership of the Canadian-based company. In November 2013 Rosatom set up Uranium One Holding NV to own and manage all its international uranium mining assets, including Uranium One Australia under Uranium One Inc, leaving ARMZ responsible for uranium mining in Russia.

In November 2013 Uranium One said it had “impaired the Honeymoon project due to continuing difficulties in the production process and issues in attaining design capacity, combined with high mine operation costs. The carrying value of Honeymoon was therefore written down by $67.8 million.” A week later it was announced that the mine would be closed pending improved uranium markets and put on a care and maintenance basis.

In 2015 Boss Resources Ltd based in Perth bought Uranium One Australia, which owned the mine and asociated deposits, for A$11.5 million in staged payments plus up to $3 million from operating cash flow. Boss formed a joint venture with Wattle Mining Pty Ltd (Boss 80% and Wattle 20%) to take over Uranium One Australia. Boss had an option to acquire Wattle’s 20% after completion of a bankable feasibility study, and in December 2017 exercised this.

Production:

First production by Uranium One was in September 2011. Production in 2012 was expected to be 275 tonnes U3O8, at $47/lb – much more than the company's average cost of production in Kazakhstan, but commissioning was drawn out and resulted in only 155t production. In 2013 production was 112 tonnes U3O8 until it ceased by the end of the year. Total production over about two years was 312 tonnes U3O8. The uranium content of liquor was only two-thirds of the design level, which was the major factor among several which limited production.

Boss Energy in 2020 said that Honeymoon has “near-term production” potential on the basis of A$170 million plant and infrastructure in place. A preliminary feasibility study completed in May 2017 was positive. A field leach trial over June to November 2017 yielded very much higher uranium recovery – averaging 80 mg/L – than during the first phase of production to 2013. In October 2017 it announced that the ion exchange (IX) pilot plant (eventually to replace the SX circuit) was working well. This is located away from the main plant.

Boss completed a definitive feasibility study in January 2020. This provided a base case to rapidly restart uranium production from the central Restart Area at 907 t U3O8 (769 tU) per year over a 12-year life-of-mine, refurbishing the existing plant for A$93 million. The estimated all-in sustaining cost (AISC) is US$27/lb. Plans were to restart using the old SX plant, slightly modified, while a new IX plant is built; then ramp up production to 900 t U3O8 per year using both plants; then expand the IX capacity and go to 1450 t U3O8 per year. In September 2020 the company decided to replace the old SX columns with NIMCIX* columns before restart. The main mining lease is fully permitted, including for export of 1500 t U3O8 per year. In June 2022 Boss approved the final investment decision for the in situ project and said it expected production to begin during the final quarter of 2023.

* The NIMCIX contactor is a continuous ion-exchange (CIX) column developed by the National Institute for Metallurgy (NIM, now Mintek).

Appendix

OD expansion: BHP reduced smelting plans 2007 to 2014

In mid-2007 BHP Billiton proposed an alternative treatment strategy, which became part of the base case. This would involve exporting some product as copper concentrate rather than only refined copper, and hence exporting some uranium still contained in the copper concentrate. Because the Olympic Dam ore contains copper, uranium, silver and gold in close association, the common procedure of simply selling a copper concentrate with precious metals has not been viable, since some of the uranium would be in it, creating both processing and safeguards complications for the smelter operator. Most of the uranium is removed at the flotation stage after the copper sulfide is separated from the remainder of the ore, which is then tailings, and the main uranium recovery is from acid leaching of these tailings. Secondary uranium recovery is from acid leaching the copper concentrate, which then goes on to be smelted, containing about 45% copper and up to 0.15% uranium. At present smelting is done at Olympic Dam, followed by electro refining, and the further traces of uranium are recovered at these stages.

The proposal then became to export much of the copper concentrate with enough uranium still present to require the application of non-proliferation safeguards, so that it was all accounted for. Hence smelting could only be undertaken in one of 36 countries with which Australia has a bilateral safeguards agreement, plus the heavy industry infrastructure required. China is the prime destination and could build dedicated facilities, as could Japan.

With eventually two-thirds of the copper concentrate from the expanded Olympic Dam operation being exported as concentrate, up to 2000 tonnes of uranium would be involved annually. The major part of the uranium – about 14,400 t/yr – would be recovered and processed as at present. This copper concentrate export strategy for the expanded production from Olympic Dam would diminish the investment cost of the expansion, since smelting and refining for most of the copper increment would not be required. The infrastructure needed at Olympic Dam to operate it – notably electricity – would also be less. A new smelter in China or Japan would be lower cost. However, unless it was owned and operated by BHP Billiton itself, there would be no flexibility in concentrate sales.

Plans for expansion of the mine would mean that 800,000 t/yr of copper concentrate derived from the higher-grade ore would be smelted onsite to produce 350,000 t/yr of refined copper product, and 1.6 million tonnes would be exported to be smelted in China or Japan to yield about 400,000 tonnes of refined copper. This lower-grade portion (mostly chalcopyrite – CuFeS2) would have up to 2000 t of uranium in it (not more than 15% of total uranium) to be recovered there. Total uranium production would then be 14,400 tU from the hydrometallurgical plant onsite and 1700 tU from the exported concentrates, total 16,100 tU (19,000 t U3O8) per year. Gold production would be 25 tonnes per year.